With the advent of technological advancement and growth in all domains of life, bank services and financial facilities have become practical, readily available, and easy to access for all individuals with diverse economic settings and categories. Previously, bank services and monetary facilities were only accessible to various people.

Please visit the free financial services and payment course to learn more about ACH payments and payment processing.

What is ACH?

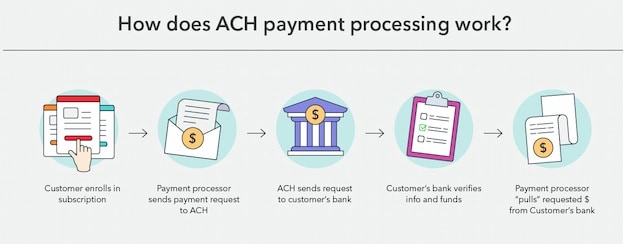

ACH, or Automated Clearing House, is a system for electronically transferring money between accounts at different banks. An ACH direct deposit is an electronic transfer from a business or government entity to a consumer.

Still, all financial transactions and monetary dealings are carried out through an authorized bank account’s established channels. Therefore, a registered bank account will enable you to monitor your financial standings and make transactions and cash crediting/withdrawal effortless and quicker.

The ACH, or Automated Clearing House, is a system that allows businesses and individuals to make electronic payments to each other. The ACH process involves several steps, beginning with the originator submitting a payment request to their bank. The bank then sends the payment request to an ACH operator, who routes the request to the recipient’s institution. Once the recipient is a recipient, the funds are transferred from the originator originator recipient. acrecipient’sof the critical advantage of using ACH payments is that they often have lower processing fees than traditional wire transfers or paper checks. Additionally, because these payments are digital, they can be processed much more quickly than conventional methods.

If you’re interested in using ACH payments for your business or personal finances, one important thing to remember is that there may be holds placed on your funds when you initiate an ACH payment. This means that even though you’ve sent a request to your bank or another financial institution requesting a money transfer, it may take some time before those funds become available in your account.

So why do banks place holds on ACH payments? Generally speaking, this practice is used as a security measure to protect against potential fraud or non-payment by either party involved in the transaction. While this can sometimes be frustrating if you’re waiting for funds to become available in your account, it’s important to remember that these holds are put in place for good reason and help protect you against financial losses if something goes wrong with your transaction.

If you have questions about how ACH holds work or need assistance initiating an electronic payment through the ACH network, contact your bank or another financial institution for help.

What is ACH Hold?

ACH hold means that your authorized payment will be deducted or deposited. When you see (Automated Clearing House) ACH hold, the ACH entry is sent to your bank; the bank is aware of the transaction, so the bank places a hold on your account, and after checking, the payment amount will be realized.

For example, “ACH hold Come “city” means that “your transaction from Comenity Bank is on hold because the bank is aware of the transaction. Soon, your money will be deducted or deposited.

Sometimes, even digital wallets can have ACH hold payments. For example, “ACH hold Venm” payment” means that “you’reransaction from your Venmo digital wallet is on hold because the bank is aware of the transaction. Soon, your money will be deducted or deposited.

To sum up:

ACH hold process is:

- ACH entry is sent to your bank

- The bank is aware of the transaction

- The bank places a hold on your account

- The bank will check your account

- Your money will be deducted or deposited

Countries have different rules regarding moving money to and from a bank account. Keeping a bank account safe is universal in every country, but there might be a few variations regarding the overall safety of the cash input. The authorities try to focus on enhancing individual bank security, avoiding money embezzlement and digital forgery, leading to hefty damage. In the United States, the Automated Clearing House, or ACH, is a safety net used to relocate and move money electronically to and from a separate bank account. The establishment of the National Automatic Clearing House Authority is behind ACH.

ACH has been moving the electronic movement of capital since the 1970s. This establishment is widely known to transfer a monetary limit of more than $51 trillion in 2018. In 2018, ACH exhibited a substantial increase of around 10% in payment transactions and emerged as a reliable platform to electronically redeploy money for the government, private consumers, state-owned and private businesses, and international firms. With this plplatform’sehelplatform’s-backelectronic transactions have been made quicker due to a slight decrease in visa and master card networks. Unfortunately, the ACH system has not been made accessible to places and accounts outside the United States and only applies to bank accounts of US origin.

Categories of ACH

There are two main categories of the Automated Clearing House payment method.

- Direct deposits

- Direct payments

The company uses direct deposit or automated payments from businesses or governments to employees or customers. This includes payroll, salaries, employee benefits, health facilities, government benefits, reimbursements, tax refunds, annual or annuities, social security payments, one-file debt, and interest payments. Direct costs are preferred when an organization or individual aims to make an electronic payment or transfer funds.

Difference between ACH payments and wire transfers

When it comes to moving money between accounts, several different options are available. Perhaps the most common method is ACH payments, which allow funds to be transferred electronically between two accounts. However, another popular option is wire transfers, which are processed in real time and are guaranteed to arrive on the same day.

While ACH payments and wire transfers offer speedy and reliable funds transfer methods, there are some key differences between them.

The most significant difference between ACH payments and wire transfers is that wire transfers are processed in real time, while ACH payments are typically processed in batches three times a day. As a result, when you use a wire transfer to send money, you can be sure that it will arrive on the same day. However, With an ACH payment, the funds may take several days to process before they appear in your account.

Another critical difference between these payment methods is cost. While some banks do not charge for wire transfers, others may charge customers up to $60 for each transfer they make. This can make wires more expensive than ACH payments, which usually only require a small fee per transaction.

Whether you use ACH payments or wire transfers depends on your needs and preferences as a user. If you need fast and reliable access to your funds without paying much for the privilege, then an ACH payment might be correct. But if speed and certainty of arrival are your top priorities when moving money around, then a wire transfer might be a better choice for you.

Unauthorized ACH funding holds

Immediately taking action is essential when you notice an unauthorized ACH funding hold on your account. Holds are designed to give you and your bank a window to spot suspicious transfers and prevent them from going through.

If you find an unauthorized hold on your account, the first step is to contact your bank or credit union immediately. Let them know about the hold so that they can investigate what happened and take any necessary steps to protect your funds.

In many cases, an unauthorized hold may result from a scammer trying to access your account. They may have stolen your personal information to gain access and initiate fraudulent transactions. In this case, it is essential to work with your bank or credit union to limit any damage that could be done and prevent future attacks.

Another common reason for unauthorized holds is identity theft, which often involves using stolen credentials to access accounts online. This can happen when someone obtains your username and password for online banking or another online service and then uses these details to log in and transfer money from one account to another without your knowledge.

Regardless of why you’re receiving a reauthorized funding hold on your account, it’s important to ignore it or delay taking action. The faster you address the issue with your bank, the sooner they can help resolve this problem and restore peace of mind about the safety of your funds.

What is an ACH hold check order fee?

An ACH hold check order fee is a charge that some banks may levy when you order checks through the Automated Clearing House (ACH) network.

The ACH hold check order fee can range from 7 cents to as high as $1.5 in 2022. It is typically charged in addition to any other fees that your bank may charge for check orders and helps cover the costs associated with processing these checks through the ACH network.

While most banks charge an ACH check hold order fee, not all do. If you are unsure whether your bank charges this fee, contact them to learn more about their specific policies and procedures for ordering checks.

ACH holds are used to transfer money using the ACH network. These holds ensure that funds are in place before completing transactions, helping to create a more secure transfer process.

If no ACH holds were in place, this could open up several opportunities for fraud or misuse of funds. By requiring individuals to confirm that they have sufficient funds available before completing transfers, the ACH network can help protect against these types of issues and keep money moving safely and efficiently through the system.

ACH holds Venmo payment

ACH holds are a common practice financial institutions use to help prevent fraudulent transactions and activity on your account. When you pay using Venmo, the funds will typically be transferred instantly from your bank account to your Venmo account. However, in some cases, a brief hold may be placed on these funds while the transfer is processed.

This hold can vary in length depending on several factors, including the payment amount, whether or not it is being sent to another person or business, and the type of payment method used (such as a debit card or credit card). Typically, ACH holds last for 1-3 days, but they can sometimes last even longer in certain situations.

If you are concerned about an ACH hold on your Venmo payments, there are a few things that you can do to reduce its impact. First, you can limit the smaller payments you send with Venmo. Instead, consider making larger lump sum payments. This will allow you to get your money faster and avoid transfer delays.

You may also consider linking a credit card or PayPal account with your Venmo account. This allows you to take advantage of instant transfers through those services rather than waiting for ACH holds to clear. However, remember that this option may not always be available depending on where you live and what banking options are available in your area.

Overall, ACH holds are a normal part of using Venmo or other similar payment platforms. If you want full control over when your funds arrive in your account after sending a payment, it is essential to keep this delay in mind when using these services and plan accordingly.

Benefits of using ACH as a payment platform

ACH is preferred by US citizens and residents who have to carry out ongoing and frequent US-based bank-to-bank dealings. This way, the account holders increase the US Bank infrastructure and benefit their pocket as it is incredibly affordable and almost cheap. Contrary to the card networks, the ACH is exceptionally reasonable and can be used by nearly everyone to transfer funds daily. The ACH has no expiry date, contrary to the card system. The credit and debit cards usually become invalid, and the account holders are expected to re-instigate the renewal process. Using ACH reduces the chances of involuntary churns, and anyone with basic ACH knowledge with a valid bank account can easily use this process.

When you configure and create an automatic payment connected with the company, the entire checking account information and credentials are frequently sanctioned to provide credit funds. For example, you can authorize your gym to extract monthly subscription fees directly if you are a regular gym visitor. This is channeled through ACH, where the gym’s gym services accelerate the payment process whenever a monthly payment is due.

The bank directly approaches the ACH entry, after which the bank puts a hold on the account to process the payment amount. After a few working days, the ACH entry is formally processed, and the money transfer, withdrawal, and credit are completed. An automatic payment system is considered convenient, but it is not quick. Credit the money to the bank holder a few days after authorizing the establishment to process the funds. During this time, the bank must reconcile and settle that transaction, so the holder needs to give a few days for the completion process.

When the bank receives a green signal from an authorized company or establishment for the money movement, it places a hold on the funds in the account to show that they are available for settlement. When the account holder is alerted of the ACH hold, the payment is about to be processed, and the funds are no longer available for the holder to spend on any other facility or service.

Suppose the bank holder cannot recognize the company that has created an ACH entry. In that case, you can immediately contact the bank manager or credit union to minimize the risk of forgery or theft. These holds are imperative in preventing fraud and theft. They alert the account holders that the money will be extracted from a particular account before the transaction occurs. This gives a shred of supporting evidence for the holders to evaluate and adequately monitor ACH entries from establishments or companies that have not been authorized.

Account holders who have to establish a direct deposit connection with their employers are usually alerted of a pending ACH credit the day before the total amount of money. An awaiting honor involves the transfer of funds directly into your account, contrary to the ACH debit. In this case, money is not withheld from the account but rather added to the account. Therefore, before the complete transaction of the ACH credit funds, these funds will not be available for the account holder to spend but will be accessible after the transactions. If you are looking for a faster yet more convenient way to send money, you can opt for a social payment money method that only requires the recipient’s number. These apps will allow you to transfer money to people with essential information through bank accounts, credit cards, or an in-app balance.