As a freelancer or business owner, you certainly make a lot of credit card and debit card transactions. Yet, if you check your Stripe account or bank report, you can see one odd number, “ARN.”

What is the Acquirer Reference Number?

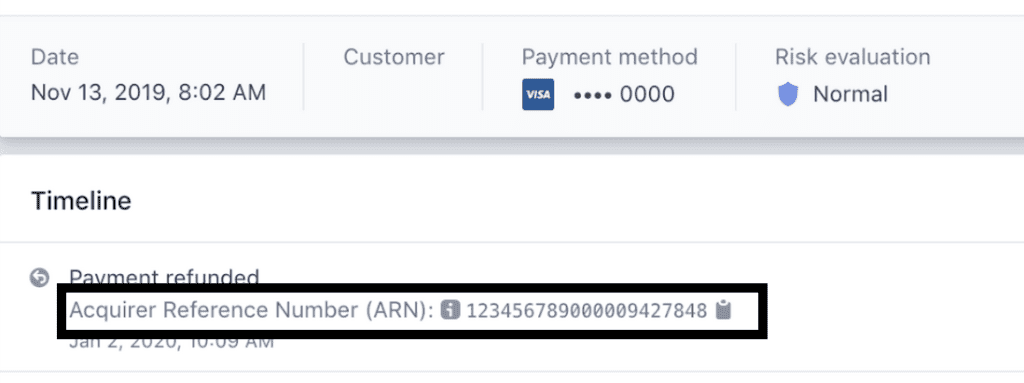

Acquirer Reference Number represents several digit numbers generated during online debit or credit card transactions such as electronic funds transactions, partial settlements, and funds transfers. For example, 123456789000009427842 Acquirer Reference Number is generated after a credit card transaction, and now the bank using this number can trace this transaction.

“ARN” is an acronym for “Acquirer Reference Number,” an exclusive figure assigned to every online payment as it moves towards and after a merchant’s and a cardholder’s bank.

The Acquirer Reference Number (ARN) is a unique code the acquiring bank or financial institution assigns to a transaction. It identifies and tracks transactions and is essential for any disputes or chargebacks.

Here’s a practical example of how the ARN works:

Let’s say you use your credit card to purchase a new laptop from an online retailer. The acquiring bank processes the transaction, and you receive a transaction receipt with an ARN number. A few days later, you notice the laptop is not working properly and decide to return it for a refund. You contact the retailer, but they refuse to issue a refund.

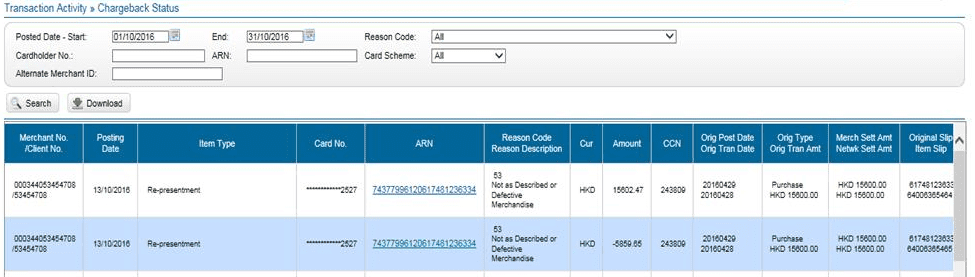

In this case, you can contact your bank and dispute the transaction by providing them with the ARN number. Your bank can trace the transaction and investigate the issue using the ARN number. If it is found that the retailer was at fault, the bank can initiate a chargeback to reverse the transaction and refund your money.

Here’s a theoretical example of how the ARN works:

Let’s say a customer uses their credit card to purchase a meal at a restaurant. The acquiring bank assigns an ARN number to the transaction and sends it to the card issuer for processing. The card issuer approves the transaction and sends the funds to the acquiring bank.

However, the customer later disputes the transaction and claims that they did not make the purchase. In this case, the acquiring bank can use the ARN number to track down the transaction and provide evidence that it was valid. If the dispute is still unresolved, the bank can initiate a chargeback and provide the ARN number as evidence to reverse the transaction and refund the customer’s money.

This Acquire Reference Number must always be provided to both merchants and banks participating in the transaction; however, in certain instances, the consumer will also find it relevant.

How do I find the ARN number?

The Acquirer Reference Number (ARN) is a unique code the acquiring bank or financial institution assigns to a transaction. Here are the general steps to find the ARN number:

- Look for the transaction receipt: If you have made a payment or transaction through a debit or credit card, you will receive a transaction receipt. The ARN number is usually printed on the ticket.

- Check your bank statement: The ARN number is also on your bank statement. Look for the transaction in question and check for the ARN number.

- Contact the acquiring bank: If you cannot find the ARN number through the above steps, you can contact the bank or financial institution that processed the transaction. Please provide them with the necessary information, such as the date and time of the transaction, transaction amount, and card details. They should be able to provide you with the ARN number.

Note that the process may vary depending on the specific bank or financial institution involved in the transaction.

What is the function of ARNs?

ARNs are the transaction identifiers given to card payments so they can be tracked. The assignment of these one-of-a-kind numbers to each debit and credit card deal allows for discovering functional and potentially beneficial information if problems arise between merchant accounts and banking institutions. Furthermore, they used to keep track of transactions involving refunds for things purchased online.

Since the COVID-19 epidemic, there has been an increase in online purchasing, which implies an increase in fraudulent activity and unauthorized transactions. Since ARNs allow businesses to track a trade’s progress from the moment a payment is received until it is safely deposited in a bank account, they are valuable for marking out unapproved dealings and preventing the processing of fraudulent charges. In addition, tracing these transactions can help stop fraudulent payments from being processed.

Ensure you supply as sufficient information as possible regarding details about your refund and return, such as the serial numbers, cost, mode of payment, and timestamp, so the wholesaler or bank can locate your Acquire Reference Number as quickly as possible.

If a retailer receives a client request for an ARN, the seller may either call their bank for assistance or, whether they employ a payment service, check the panel for the relevant transaction to see if the ARN is shown there. The merchant should contact their bank if a customer has requested an ARN.

As soon as they have identified it, the following statuses will be displayed, depending on wherever the process of being refunded is. In addition, they can provide you with relevant updates or a number you may call to deal with the matter directly through your bank. These are the available statuses:

- The Acquire Reference Number is the status that will be assigned automatically if repayment is generated. It indicates that the process of issuing the reimbursement has begun, but it has not yet been completed.

- The ARN is now available and will be shown inside the reimbursement itself.

- ARN is inaccessible – This message will appear if, e.g., the bank refund is produced before the bank has processed the initial charge. In this scenario, the fee server would often cancel the payment after reversing the authorization and dropping the order. As a result, the transaction will be removed from the cardholder’s bank account report, and an ARN is not required.

If you want to track down a refund for an online payment you made with a debit or credit card, the most critical situation in which you would wish to know of an ARN is when you are trying to do so.

In most cases, the retailer can promptly return the payment amount to you using the same credit or debit card used to complete the initial purchase. However, this may take some time in some circumstances; hence, you may wish to obtain an update to determine how long you should anticipate waiting until you receive your refund.

Your bank and the merchant’s bank both have access to the ARN, which means that you can either follow the refund yourself or the merchant can keep you updated on its status.

This unique number significantly impacts the trustworthiness and safety of online card transactions. Furthermore, both the client and the business owner can monitor the progress of the trade until the money is deposited securely into the appropriate bank account, which gives both parties a sense of relief.

Is there any other way to look into a transaction made with a credit card?

Transactions made with a card can also be tracked using a System Trace Audit Number (STAN). The cardholder’s bank often creates a six-digit number internally to identify a transaction. It is used to verify that the cardholder authorized the transaction.

You should use an ARN rather than a STAN in most situations. This is because ARNs are 11-digit codes, which indicates that they are genuinely unique. As a result, they are more traceable than STANs, which only have six digits because the code is reset after 999,999.

How do you generate an ARN number?

The Acquirer Reference Number (ARN) is generated by the acquiring bank or financial institution that processes a transaction. Therefore, you cannot generate an ARN number alone as a user or customer.

When you make a payment or transaction using a debit or credit card, the acquiring bank or financial institution assigns a unique ARN number. The ARN number is usually printed on the transaction receipt and used to identify and track the transaction.

If you are a merchant or business owner, you can generate a new ARN number for each transaction by contacting your acquiring bank or payment processor. They will provide the necessary information and tools to generate an ARN number for each transaction you process.

In summary, you cannot generate an ARN number as a user or customer. It is caused by the acquiring bank or financial institution that processes the transaction. However, if you are a merchant or business owner, you can generate an ARN number for each transaction by contacting your acquiring bank or payment processor.

Summary

ARN is a one-of-a-kind number assigned to every credit or debit card payment that moves back and forth between the bank of the merchant and the cardholder. This Acquire Reference Number is essential to the merchant and the banks participating in the transaction; nevertheless, the consumer will find it relevant in some circumstances.

Transactions made using credit and debit cards are given ARNs to mark them observable if an error occurs or a consumer wishes to check the compensation status. They’re likewise important for tracing illegal transactions and blocking duplicitous expenses from being executed.

Suppose you are attempting to track compensation for a payment you created online using a debit or credit card. In that case, you may monitor your balance to comprehend where it is in the process of being refunded or to determine whether or not it has vanished entirely.

You can retrieve the ARN by contacting either your bank or the merchant’s bank because both banks have admittance to it. This allows you to choose whether you wish to monitor the reimbursement personally or would rather have the merchant update you on its status. You may also track a card payment using a System Trace Audit Number (STAN). Nevertheless, it is advised that you practice an Acquire Reference Number since they are lengthier, which means they are unique. This is the case in the majority of situations.

You may not be familiar with the following payment abbreviations: 3DS, an acronym for 3D Secure; EFT, an acronym for Electronic funds transfer; and SSL, an acronym for Secure Sockets Layer.