Residential objects on the land are structures built to provide shelter and safety to people living in the space, either permanently or temporarily. These properties range from traditional single-family homes, apartments, and condominiums to townhouses, mobile homes, manufactured homes, and more. Homeownership is a right that is often taken for granted, but it provides access to stability and security that is hard to find in any other type of housing. Purchasing a home usually requires taking on a loan or saving up enough money to cover the costs associated with the purchase – such as closing costs and maintenance fees. Residential objects can also provide a great investment opportunity, as real estate prices have historically increased.

Homeownership also provides many personal benefits, including the ability to customize a living space according to one’s preferences and tastes. Moreover, homeowners typically benefit from tax advantages and build equity in their property over time by investing in home improvements or paying down their mortgage principal. Owning a home also allows individuals to be part of a neighborhood or community where they can participate in local activities and form relationships with neighbors.

For residential properties to function properly and sustainably for long periods, owners must take appropriate steps regarding legal documents regarding ownership rights, insurance policies, zoning regulations, local tax laws, building codes, pest control measures, health regulations, fire inspections, small business licenses; utility connections; home improvement projects (such as renovations); and more. All these components must be addressed before the homeowner can move into their new residence safely and comfortably.

Therefore, while residential objects on the land property provide an incredible sense of safety, security, and stability to those who inhabit them, owning such an object requires diligent research into relevant local laws and responsibility regarding maintenance obligations. With proper care and consideration, these properties can provide lasting memories for generations!

What is ADU?

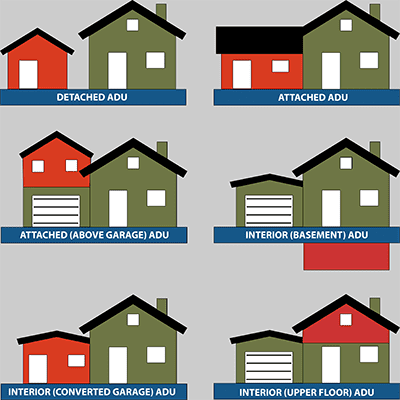

Accessory Dwelling Units (ADUs) are small, independent living spaces that can be attached to or detached from an existing residential building. They offer homeowners a unique way to gain extra living space on their property for rental income or additional family members.

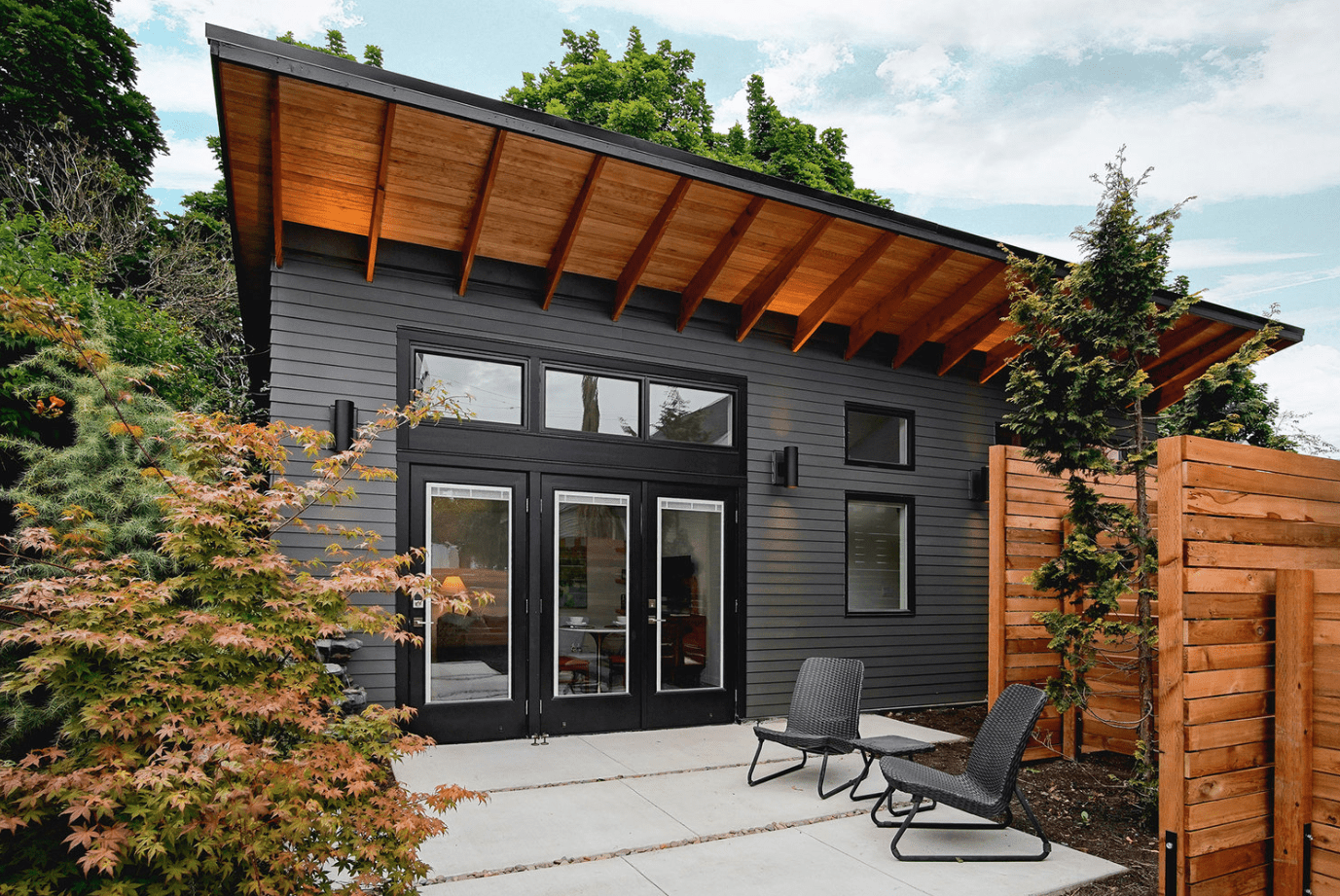

Depending on the municipality’s rules and regulations, ADUs can take many forms and sizes. Options include converting a basement, garage, attic, or detached structure into a livable space. They are usually smaller than the primary residence in size and may include features such as kitchens and bathrooms. ADUs are often constructed from wood framing with energy-efficient materials like insulated siding and windows. In addition, special attention is paid to ensuring all safety requirements are met, such as sprinkler systems and fire alarms.

ADUs provide many benefits for homeowners, including increased rental income potential and flexible housing options for extended family members or aging parents. Similarly, they can benefit local communities by providing additional affordable housing options without burdening infrastructure or public services like schools or parks.

Furthermore, due to their small size, ADUs offer unique design opportunities. They can be easily customized to meet the needs of their occupants while staying within local codes and ordinances. They can also help conserve energy using efficient insulation materials while maintaining comfortable indoor temperatures year-round. For example, green roofs with vegetation absorb the sun’s heat in the summer and reduce cooling needs during hot weather conditions while helping with stormwater runoff management at the same time.

Overall, ADUs offer an innovative solution for homeowners looking to increase their property value by creating additional living spaces that can accommodate multiple generations of family members or generate rental income through tenants. They also offer attractive options for municipalities seeking affordable housing without overburdening public services or infrastructure. With careful consideration of local codes and regulations and energy efficiency features such as green roofs and insulated siding and windows, Accessory Dwelling Units represent an excellent way for homeowners to add value to their properties while contributing positively to local communities at the same time.

How much does an ADU increase property value?

The ADU can increase from 10% to 30% property value. An accessory dwelling unit or ADU is a legal term for a secondary house or apartment that shares the building lot of a larger, primary home.

Many people are looking for alternative housing options in a world where affordability and convenience are important factors for homebuyers. An Accessory Dwelling Unit (ADU) is a great solution to meet the needs of both buyers and sellers. An ADU is a self-contained living space attached or detached from an existing single-family home. They can be used as additional living space, rental units, in-law suites, vacation rentals, or other purposes.

The financial benefits of building an ADU have been well documented. Generally, these structures increase the value of a property by up to 20%. In addition to the potential for increased property values when selling, homeowners who build ADUs often experience increased rental incomes. Building an ADU also allows homeowners to enjoy more space and privacy while generating extra money from renting out their new living space.

However, it’s important to note that many factors determine how much an ADU increases your property value. Location plays a significant role; properties in desirable neighborhoods tend to appreciate more quickly than those in less desirable areas. The size and scope of the project may influence the resale value; if you plan on including luxury amenities such as granite countertops or stainless steel appliances, you may see a greater return on your investment down the road.

Another factor influencing property value is zoning regulations. Some cities have restrictions on how large your ADU can be or may require special permits before construction can begin—both of which can affect your project’s overall cost and timeline. To avoid problems, it’s always best to check with your local zoning department before starting any home improvement project.

Lastly, it’s worth noting that not all homebuyers are enamored with ADUs — some view them as less desirable due to their smaller size or shared walls with another unit — so it’s essential to consider this when making decisions about whether or not to build an ADU and how much money you should put into it before listing your property on the market.

To learn more about How to Calculate Land Value, you need to analyze our articles :

- Does Rezoning Increase Property Value?

- Does Clearing Land Increase Property Value?

- Does a Barn Increase Property Value?

- Do Fences Raise the Property Value?

- How much does a shed add to property value?

- How Much Does an ADU Increase Property Value?

- How Much Does a Guest House Increase Property Value?

- Does a New Roof Increase Property Value?

- How Does Subsidence Affect Property Value?

- How Much do Power Lines Decrease Property Value?

Overall, building an Accessory Dwelling Unit (ADU) can be a great way to increase your property value without breaking the bank — but it’s essential to ensure all details are taken care of beforehand to maximize its resale potential down the road!