If you have a gift card hanging around at home, chances are excellent that you’ve pondered how to turn it into a cryptocurrency, whether you’re new to the world of cryptocurrencies or not. The simplest method for most individuals to accomplish this is to sell their gift cards online for cash and then use the money to buy Bitcoin or ether.

The next step is to locate a cryptocurrency market (exchange or marketplace) that accepts gift cards as payment. You may use a Visa gift card to purchase Bitcoin, Litecoin, and other cryptocurrencies. You must purchase the desired amount on a Visa gift card at the closest retailer before converting it to Bitcoin.

There are dozens, if not hundreds, of cryptocurrency exchanges accepting Visa credit cards and debit cards. Debit and credit card transactions are often instantaneous. There aren’t a lot of locations where you can exchange gift cards for cryptocurrencies, but the ones we’ve included below are some of the more reliable ways to do so.

Buying Bitcoins with a Visa gift card

You can buy bitcoins with a Visa gift card by visiting crypto exchange apps such as Uphold, LocalBitcoins, and Paxful. You can get a Visa gift card and buy any crypto using these apps. However, you must verify your address and account before purchasing a large amount of crypto.

Visa gift cards are prevalent and frequently traded online for other products and services. Any big shop that sells gift cards will have them. However, you can now purchase Bitcoin using this card for different things. You may now use a Visa Gift Card to buy Bitcoin (BTC) on several sites, including Paxful. Purchasing Bitcoin using a Visa gift card is a lot easier, thanks to Paxful.

List of crypto exchanges that accept Visa gift cards:

| Error | Why | What to do |

|---|---|---|

| Sunbeam Electric Blanket Blinking F | issue with a power supply or connection error. | Reset the blanket |

| Sunbeam Electric Blanket Flashing blue | check all connections | Reset. |

| Sunbeam Electric Blanket Flashing E | power cord is disconnected from the blanket (no connection) | Reset the blanket |

| Sunbeam Electric Blanket Flashing E2 | connection lost between the blanket and the control box or control box is not connected to a wall outlet | Reset the blanket, wait few minutes to blanket cold. |

| Sunbeam Electric Blanket Flashing F1 | bad connection between the power cord and the blanket | Reset the blanket |

| Sunbeam Electric Blanket Flashing F2 | bad connection between the controller and the banket | Reset the blanket in few minutes |

| Sunbeam Electric Blanket Flashing FF | gradient controls and warming error | Check connection between the control and the module. Fix connection. Reset. |

| Sunbeam Heated Blanket Blinking Yellow Light Error | connections between the power cord and the wall outlet is wrong. | Check connection and reset. |

| Sunbeam Heated Blankets Blinking Orange | power issue | Check power. Then Reset. |

Using a Visa gift card to purchase a small portion is a terrific way to begin investing in Bitcoin if you’re just getting started and don’t have the money to acquire Bitcoin in large quantities. You can always buy Visa gift cards with cash or get them by making other purchases online. You must first own a gift card before using a Visa gift card to purchase Bitcoin.

As was already said, it’s not hard to buy Bitcoins with Visa gift cards on well-known exchanges like Paxful. You may choose from various alternatives to find one that works for you. For instance, you must first register an account to purchase Bitcoin on Paxful. Then, you may use the “Buy Bitcoin” option to search for a Visa gift card. You may start a deal with the Bitcoin vendor and agree on the conditions. After that, it will deliver Bitcoin directly to your Paxful wallet. On the platform, vendors are free to determine their transaction margins and set their prices. Additionally, you can build offers you believe have a higher possibility of conversion.

How To Buy Bitcoin With Visa Gift Card?

- Choose a cryptocurrency exchange such as Uphold, LocalBitcoins, and Paxful

- Register on the platform

- Add Visa debit card

- Choose “from” debit card “to” Bitcoin

- Set the amount and buy the BTC

Please see the video:

Before deciding to buy Bitcoin (BTC), you must use caution. As you’ll see, the procedure is simple. The token is highly well-liked and is traded on many different cryptocurrency exchanges. The most lucrative price is the one you should pick incorrectly since such a trade can dupe con artists. But it needs accuracy, just like any Bitcoin transaction. The exchanger’s reputation and how secure transactions are in its network are essential things to consider.

You must enter your information to sign up for an account on the Bitcoin exchange. It’s essential to approach this matter appropriately. Any inaccuracy in entering the data might result in financial loss, as well as the loss of a targeted deal. The same level of care must be used while deciding on a payment option and entering the details for your gift card.

As you can see, purchasing BTC with a Visa Gift Card is a simple and quick process. The most important thing is to carefully select the store where you buy and precisely input all your registration information. Following that, it won’t take long for you to buy Bitcoin (BTC).

Can you buy Bitcoin with a Visa Gift Card on Coinbase?

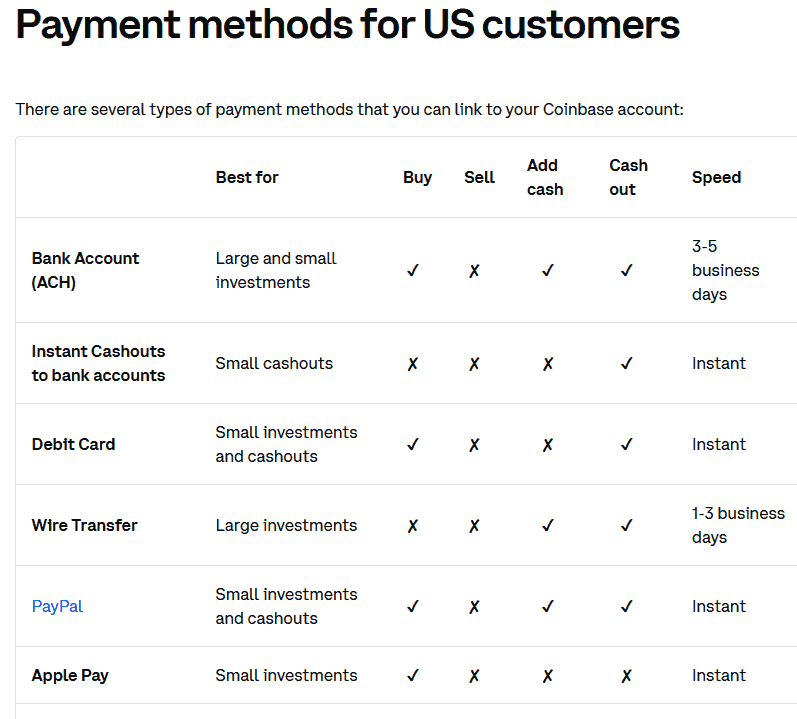

You can not buy crypto with a Visa Gift card on Coinbase because this company accepts only cards with billing addresses. However, Visa and MasterCard debit cards can be used to buy on Coinbase.

What are the best sites to buy Bitcoin with gift cards?

The best sites to buy Bitcoin with gift cards are Uphold, LocalBitcoins, and Paxful. Uphold has the fastest app for adding your Visa Gift card and purchasing crypto.

LocalBitcoin is a peer-to-peer Bitcoin exchange. The platform enables people from all over the world to connect and exchange bitcoins from any location. The platform escrows the cash at stake to safeguard users against fraud during the transaction. Like LocalBitcoins, Paxful is a peer-to-peer Bitcoin marketplace with many payment options and a secure escrow service enabling users to trade cryptocurrency money.

That stops the seller from taking the buyer’s bitcoins after completing the transaction. Coins are only released to the buyer by Localbitcoins when the seller has received payment in full. The website encourages users to research the person they are exchanging with before engaging. That is strongly advised. If an account is confirmed with an ID card, users may view the number of trades a potential counterparty has made on the platform. This information includes typical payment and release times and signs that the other party is a genuine buyer or seller, not a scammer.

The buyers and sellers decide the conditions of the transaction. They are allowed to set their restrictions and costs. Globally, LocalBitcoin is accessible in almost all nations. However, the liquidity depends on the region’s volume of sellers and buyers. In contrast to most big exchanges, LocalBitcoin requires that you physically or digitally interact with the person you are selling to or purchasing from. The buyer and seller also decide the manner of payment. Any payment, including the gift cards discussed here, is acceptable.

Since its founding in 2015, Paxful has grown into a sizable organization with over 200 employees and various offices throughout the globe. The speed of transactions made through Paxful varies depending on the payment option and if the vendor is online. Gift cards and PayPal are two of the quickest payment options. Meanwhile, bank deposits, MoneyGram, and Western Union take longer because they involve more steps for the user and the institution they transact with. The seller cannot back out of the deal at this time.

On the other hand, the buyer is given a specific time window to deliver the cash to the seller to have the transaction declared “complete.” The sale is void if the buyer doesn’t send the money within the allotted time limit. The seller’s wallet address receives the Bitcoin automatically.

What are the other ways to buy Bitcoin?

Other ways to buy Bitcoin are PayPal, Cash, Debit Cards, Gift Cards, Wire Transfers, Western Union, and BTC ATMs.

Buying and selling bitcoins with the same app you use for all of your online payment needs is made very simple by PayPal. If you make a deal for less than $5, you’ll pay $0.50, and the costs increase. Trades between $200 and $1,000 cost 1.8 percent, and trades over $1 million cost 1.5 percent. You may trade with as little as a single dollar, and there is a spread charge on all deals, but no fees are associated with keeping cryptocurrencies in your account. In addition to Bitcoin and Bitcoin Cash, you may also trade in Ethereum and Litecoin.

People who want to acquire Bitcoin also frequently use cryptocurrency exchanges. A few significant benefits that exchanges provide dealers: The top cryptocurrency exchanges offer the lowest potential expenses for buying and selling bitcoin. If saving money is your priority, then they are your best option. Many platforms don’t charge hidden costs integrated into the trading pricing. Several different marketplaces provide wallets for you to keep your Bitcoin in.

You can buy bitcoins without paying upfront fees using a trading program like Weibull or Robinhood. However, you’ll pay more in the long run because of the spread. You may also use a Bitcoin ATM to acquire bitcoins directly, but the fees associated with this method are likely substantially higher than those associated with other methods. Some ATMs charge up to a 10% commission on each withdrawal, while the average rate is closer to 7%. At some ATMs, you may use cash or a debit card to acquire bitcoins, while you can sell bitcoins in other cases. However, you may require a Bitcoin wallet to complete the exchange.

What card types should the user choose when buying Bitcoin & Other Crypto?

Visa Card & Mastercard are some cards when buying Bitcoin & Other Crypto.

If you want to buy Bitcoin with a debit card, prepaid credit card, or bank transfer, you must ensure your bank supports cryptocurrency purchases. In reality, many banks avoid or even ban digital asset transactions because they think they threaten the current financial system. Accepted by Visa, which acknowledges them as cutting-edge technology and a crucial component of the economic system, The business permits a variety of transactions involving virtual currency. You shouldn’t have any issues purchasing Bitcoin using a prepaid Visa card.

Mastercard joined the group of cryptocurrency enthusiasts after realizing that purchasing Bitcoins using prepaid Mastercard cards is becoming commonplace in the contemporary digital environment. In 2021, it announced the inclusion of a few digital currencies on its network. This implies that you may deposit money and buy cryptocurrency on CEX.IO using Mastercard debit, credit, and prepaid cards.

Your bank account is not linked to a prepaid debit card. The card has money loaded on it that you may use for cashless transactions in physical stores or online purchasing. Use prepaid cards to add USD, EUR, GBP, or RUB to the CEX.IO account. You can use these funds to buy cryptocurrencies like Bitcoin (BTC), Ethereum (ETH), and others. However, you must use a different card to sell Bitcoin (BTC) and withdraw cash from your card because neither internet services nor payment terminals may be used to fund prepaid cards.

You may purchase using a gift card at various retail establishments, dining establishments, petrol stations, etc. They are often issued by a business where you may buy with this card. It is a handy alternative if you don’t want to use a credit card or don’t have any cash. Additionally, you may give this card to friends and family as a present. They are only available in locations where payment is accepted. Most of the time, it’s only one brand of shop or eatery. Also, you must use the whole amount deposited onto the gift card in a single transaction.

Conclusion

It’s crucial to keep expenses to a minimum if you’re trying to buy Bitcoin and other digital currencies as an investment. Although the price of Bitcoin has suddenly risen, it still contains significant risks, making it unsuitable. Many brokers would like to maximize their compensation, considering the novelty of the cryptocurrency industry. Consider reducing those frictional expenses because those fees reduce your earnings. Avoiding Bitcoin or only dealing with money you’re prepared to lose are two options for those searching for cautious investments or who can’t afford to lose money.