Conducting financial transactions and activities through plastic is easy and convenient during these times, but utilizing it appropriately would help remove confusion and discrepancies in economic activities. Playing with plastic is convenient, but choosing the right kind of card, learning how to utilize it, and understanding the peculiarities of plastic money significantly eradicate challenges and predicaments owners may encounter during the process.

These cards are almost used in everyday spending, grocery shopping, online shopping, and even essential bills. However, some cards linked to the account may experience faulty systems and irregular shortcomings while scanning.

Most account holders own plastic money. Still, to use it smoothly and experience trouble-free transactions, it is necessary to understand the fundamentals and mechanism and the merits and demerits of utilizing plastic money. Conducting monetary transactions has been replaced with electronic money transfers, and accessibility has reached all parts of the world.

We recently wrote an article on how much cash you can deposit in an ATM, and now we will continue our story and discuss issues.

ATM Card Magnetic Strip Not Working

If your ATM or EBT card’s magnetic stripe is not working, it is usually a problem with physical damage. You can temporarily reduce the signal loss by covering the card with a plastic bag or clear tape when you pay in stores. However, you need to contact the phone number on the back of the card, report card damage, and ask them to send you a new card via mail.

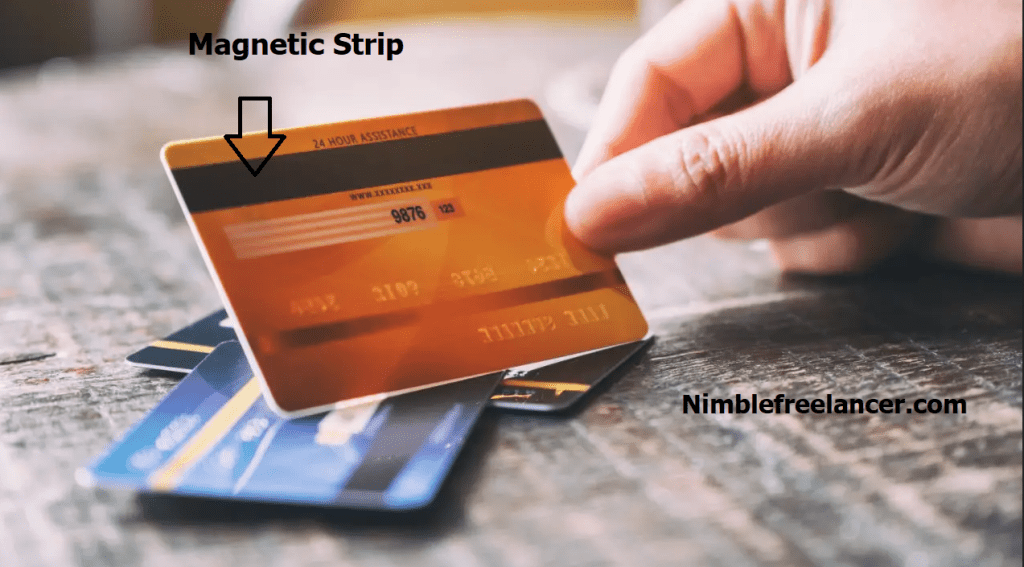

Every credit or debit card has a dark-colored stripe on the back, considered a magnetic strip consisting of vital details regarding the card and its owner. Whenever a card is inserted into the special allotted place in the ATM, the ATM detects and reads the magnetic strip and evaluates the cardholder’s information. Understanding and assessing this information is essential to authorize the transaction.

How to repair the magnetic strip on your card

You can not repair or magnetize a demagnetized card at your home. Do not try to use a magnet to magnetize the card strip because it will demagnetize your credit card. Evan fridge magnet can demagnetize credit cards if you hold them against the credit card stripe for several minutes. It is not essential how the interest is vital; it is important how long the magnet works against the credit card stripe.

You can temporarily reduce the signal loss by covering the card with a plastic bag or clear tape when you pay in stores. The best solution is to call support and order a new card.

How to demagnetize a credit card strip?

You do not need a solid magnet to demagnetize a credit card strip. You can use a fridge magnet and rub the magnetic strip for a few minutes. After a few minutes, if you hold the magnet body against the credit card stripe or rub it, your credit card stripe will be demagnetized and out of function.

ATM card readers sometimes get exhausted; therefore, the information on the back of the card is misread, restricting it from being verified. This issue must be sorted out through a professional who can analyze the card reader and check for viable options, including if the card needs to be cleaned, revamped, or completely interchanged to be activated again. The ATM is manufactured to easily detect essential information with the verification company to complete the transaction.

Occasionally, the ATM breakdowns, and swiping an ATM card with a successful conclusion is challenging. If an ATM Machine has failed to perceive the card information for the first time, it may be possible due to a technological glitch or a damaged link, but if the problem persists, there is a high chance of the card being damaged. In this event, the card should be replaced. Sometimes, that magnetic strip becomes demagnetized and wears down, which causes significant issues; therefore, contacting the financial institution is the first step to mending it.

The persistence of the problem can lead to a pause in cash withdrawal during emergencies. While contacting the financial institution is generally advised in the initial stages of the problem, it can be prevented with other solutions. For example, if card owners are experiencing frequent issues while swiping the card, the card may have an extra layer of dust, dirt, or lint. This situation can arise if the card is not stored correctly in your wallet, as placing it in open spaces makes it vulnerable to dust accumulation.

Whenever a credit or debit card is issued to cardholders, the financial institution provides a card cover for its maintenance. Dust or small particles can interfere with the reading process of the magnetic strip, which is extremely delicate and requires intensive care. If this is the case, wipe the back of the card with a clean cloth and avoid using water to deteriorate the condition further.

The card’s magnetic stripe will erode if placed near magnetized items or cell phones. This issue can be prevented by requesting an ATM card cover if it is not provided along with the ATM card. Placing it inside the sleeve will significantly reduce the chances of dust accumulation and debris clearing. The card sleeve is a protective layer for the magnetic strip and protects it from potential unintentional scratches. If a credit card or an ATM card is exposed to scratches, it is categorized as physical damage, causing the magnetic strip made of iron film to be damaged. The scratched magnetic strip will make the data incomprehensible, and the magnetic card will not process the data at all.

To reduce the likelihood of magnetic strip damage, it is advised to check it at retailers through a plastic bag to protect the strip that is not functioning correctly. Scratches and dirt accumulation will be avoided by covering the strip with a plastic bag, as exposure to dust will immensely damage the magnetic stripe. In addition, the magnetic bars’ arrangement is sometimes altered and adversely affected. Therefore, putting it in a plastic cover will allow the checkout to overlook minor errors and scratches.

Place the ATM card into a plastic bag; however, make sure there are no wrinkles, and place it through the card reader. Most car owners also protect their card’s magnetic strip with paper, a receipt, or masking tape. The checker has to slide the saved card through the card reader or the ATM. The ATMs are manufactured and pre-programmed to read the card at a particular speed; therefore, inserting and removing the card quickly is advised. If the card is inserted at a wanted rate, the ATM will not detect the card. If this fails, you can ask the checker to manually enter the owner’s information to complete the desired transaction.

Cardholders can also glue clear tape over the magnetic band, like putting the credit card in a plastic bag. This clear tape will allow the merchants or retailers to swipe the card and receive needed information. This would allow them to read the coding, but this gap will overlook slight coding errors. The last option is to insert the card details and number manually. This is undoubtedly time-consuming, but you may have to use this if there is no other option. Ensure priority cleaning of credit cards, and rather than keeping them in a wallet, put them in the bottom of the purse where they are less vulnerable.

There could also be a technical problem with the credit card. Try using the ATM of the issuing bank or any other connected bank to isolate or narrow down the problem. If the ATMs give the same message, the card must be replaced. The issuing bank will replace the damaged or malfunctioned card with a small charge.

My EBT card won’t swipe

If your EBT card doesn’t swipe, you must contact EBT Customer Service (1-888-328-6399) and report the card as damaged. The new card will be mailed to you. Additionally, you can visit the local district office and tell them about your problem.

In the meantime, you can try to use the card if you cover it with clear tape (or a plastic bag) when paying in stores.

I recently wrote an article showing how to track my debit card in the mail.