The check is a special paper where you write the Date, amount, name, and signature. The check is used in banks and printed by banks to identify everyone who wants to deposit the cash into the bank account. The check is also used to windrow cash from a bank account. If you wish to transfer the money, you fill out the cash deposit slip to transfer the cash to another account; then, the bank cashier will identify you and another person’s identity to transfer the money.

In some countries like the UK and Canada, the spelling of the check is “cheque.”

History of Check

In 1717, the Bank of England was the leading association that issued pre-printed checks. The most established Americans look at dates to the 1790s.

Present-day checks, as we are probably aware of them today, became well known in the twentieth century. Check utilization flooded during the 1950s as the check cycle became robotized, and machines had the option to sort and clear checks. Take a look at cards first made during the 1960s, which were the antecedents to the present charge cards.

Credit and charge cards—and different types of electronic installment—have since dominated checks as the prevailing method for paying for most labor and products. Checks are currently, to some degree,, extraordinary yet utilized among everybody.

There are the types of checks:

- Certified Check

- Cashier’s Check

- Payroll Check

- Bounced Check

The check can be utilized for a few reasons.

Alternatives of writing a personal check

As close-to-home checks become less famous, realize how to send cash online. Cash move applications, such as Checkbook.io, Venmo, Zelle, and PayPal, all offer free or minimal expense choices for paying companions, specialists, and any other individual you owe

Check characteristics

- A check is a composed, dated, and marked instrument that guides a bank to pay a particular amount of cash to the conveyor.

- It is one more approach to educating a bank to move assets from the payor’s record to the payee’s or individual’s record.

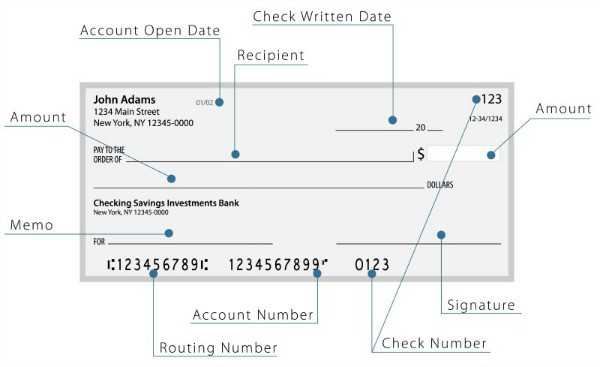

- Check highlights incorporate the Date, the payee line, the check measure, the payor’s underwriting, and an updated line.

- Sorts of checks incorporate guaranteed checks, clerk’s checks, and finance checks, additionally called checks.

How to Write a Check?

To write a check, please follow the next steps:

- Write Date on the check (top right corner)

- Write the name of the person for whom this check is being issued.

- Write the payment amount using the text

- Write the payment amount using numbers.

- Sign the check.

- Write a memo (optional)

Fill out the check step by step.

A significant number of us send cash electronically nowadays. Occasionally, we might compose actual checks to make an installment to an individual or business. Here are the means to write a check.

Fill in the Date:

Compose the current Date on the line in the upper right-hand corner. This data will tell the monetary foundation and the beneficiary precisely when you composed it. You can work out the Date totally or utilize all numbers, such as 6/10/2020 or June 10, 2020.

Write the name of the payee.

On the line that says “Pay to the request for,” compose the name of the individual or organization you’d prefer to pay. Utilize the beneficiary’s complete name rather than a moniker. If you’re looking at an organization, confirm the name of the business before composing it on the check.

If you don’t have the foggiest idea about the specific name, you can compose “cash.” However, this can be an unsafe move since anybody can have money or store a look made of “cash.”

Write the actual look at a sum in numeric structure.

The check will contain two spots, expecting you to express the sum you’re paying. In the first place, compose the mathematical dollar sum in the little box on the right of the line for the beneficiary’s name. For instance, you might compose $100.30 to write a check for 100 dollars and thirty pennies. Ensure you compose this obviously so that the bank can take away the correct sum from your record.

Write the actual look at a sum in words.

Then, you’ll need to work out the dollar sum in words to coordinate with the mathematical sum you previously composed on the line underneath “pay to the request.” Put the penny sum of more than 100. For instance, if you put $100.30 in the container, you’ll express “one hundred and 30/100.” If the check is for $100 or one more round number, you should, in any case, incorporate 00/100 for additional clarity. When you compose the dollar sum in words, you confirm the all-out installment.

Write a notice

The notice segment of the check is discretionary. Nonetheless, it’s a smart idea to round it out because it can help you remember why you wrote the check. If you’re writing the check to pay your stylist for your hairstyle, for instance, you can express “hairstyle.” If the check is intended for a specific bill, write your record number in the reminder region.

An organization might ask that you compose your record number or receipt number in this part. This will assist them with applying the installment to your record.

Account Number

Your account number. This number will be something very similar on the entirety of your checks, on a check, this number is for the most part joined by this exception.

Sign the check:

Sign your name on the line at the base right-hand corner of your check. Make sure to sign readably and utilize the signature on a document at your bank. Your mark illuminates the bank that you consent to pay the expressed sum to the payee you noted.

On the base, on the right-corner line, sign your name. This ensures the bank consents to pay the sum on the check. The accompanying parts are, as of now, filled in the check:

Bank details on the check

The upper left hand has a pre-characterized bank name, logo, and address. This load of subtleties is now composed where anybody’s record is enlisted.

Check Number

The check number is the extraordinary pre-characterized six series or various numbers at the upper right-hand side of the check. Following the individual/organization for whom the look has been drawn is fundamental.

Bank Security code

The bank security code is the one-of-a-kind security code of each bank referenced at the lower part of the check.

Client Details

This piece of the check contains client subtleties, I.e., an IBAN number for singular clients. The IBAN is the same old thing; however, it is an altered organization of your financial balance number for global recognition. The IBAN has a fixed length, containing the initial two digits of the nation code, the next two digits of the genuine look-at digits, the following four digits of the bank code, and the last 16 digits will be off your record number.

Conclusion

This article is good for you to understand how you can write check-in the right way. Using this article, you can write a perfect check and fill in the proper Date, name, sign, and numeric words. In this article, we also discuss check history and types of checks. If you fill out all retirements, then you can save your cash.

This article is straightforward to understand.