Leaving newborns and toddlers to child specialists and full-day helpers can be intimidating and overwhelming. First, it is not easy to put your children under the care of new faces, so it is imperative to do a meticulous check and detailed exploration regarding security, facilities, training, and the legal status of a particular daycare center. The parents’ ultimate priority is to be convinced about protecting their child. Trustworthy and reliable daycare facilities involve qualified staff and proficient caregivers who are professionals with degrees and certifications in childcare and help.

A credible daycare setting promotes and fosters developmental progress, considering children’s individuality and uniqueness as a particular interest. In addition, professional caregivers are specialists who promise to handle newborns and toddlers professionally regarding health and emotional well-being. Apart from the proposed professional services, the parents should also monitor and analyze the childcare facility’s legal standing and status. It is also an integral determinant for finding the proper care for your child.

Let us see the daycare EIN lookup process:

How to Find My Daycare EIN Number?

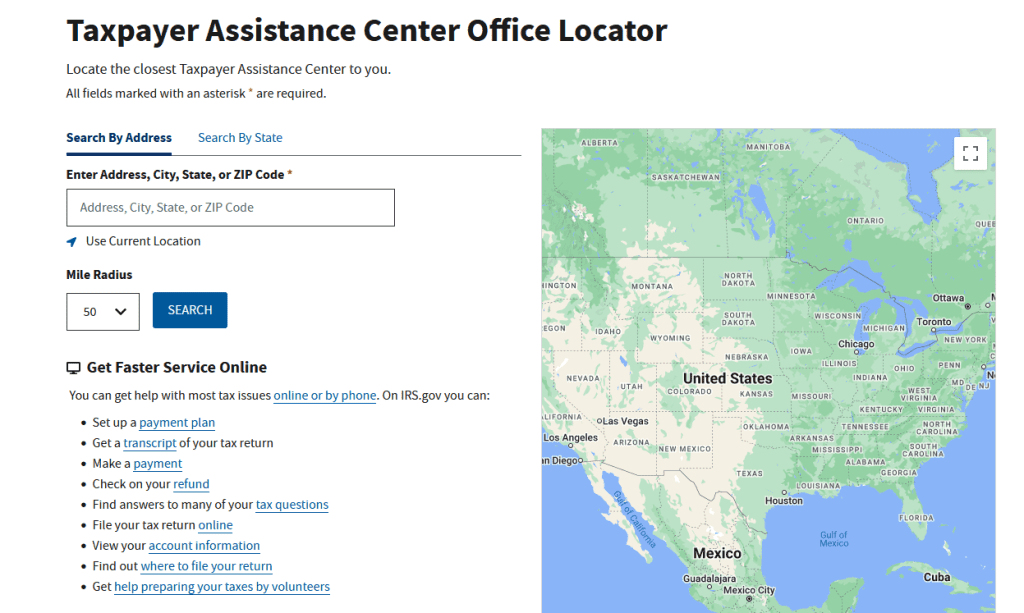

You can find Daycare EIN or tax identification numbers by calling the IRS at 1-800-829-1040 or visiting your state’s Taxpayer Assistance Center. Additional states can discover the EIN in your W-2 form, or you can contact the daycare provider by looking up the website in your state.

I will share with you steps on how I goStateagent on the main IRS phone:

If you call the IRS at 1-800-829-1040, please try these steps:

- Choose option two for “personal income tax.”

- Press 1 for “form, tax history, or pay me “t.”

- Press “3 “for all other questions” s.”

- Press “2 “for all other questions” s.”

- Do not enter when the voice asks you to enter your EIN to access your account information; do not enter.

- In the new menu, Press 2 for personal or individual tax questions.

- You will be transferred to an agent.

If you decide to call the Taxpayer Assistance Center, type the nearest location and ask for help. The center will help you with a Daycare Tax ID Number Lookup.

If you cannot find your EIN, remember you can claim childcare credit. To see the steps, read our article Can I File for Daycare Without Their EIN?

The Internal Revenue Service of the United States of America requires all businesses and entities, including childcare services and professional caregiver facilities, to declare an Employer Identification Number used to check the business’s current tax status or establishment. This number is officially used to file taxes and allows the organization to run effortlessly without impediments. Because of this, parents are advised to formally require the EIN of the particular daycare if they are interested in availing of services. Parents do not need to know the EIN of any facility; however, it may be required in specific scenarios. If you are considering applying for tax credits and deductions, you may need the EIN. Childcare expenses are drastically increasing regularly, and claiming tax credits is a blessing. To claim child tax credits, you should have the tax identification number of the childcare provider. This number will provide valuable information for document verification and determining if you can claim a tax credit under IRS guidelines.

The Tax Identification Number is obtained from the Internal Revenue Service and is a prerequisite for all businesses, including daycare providers. This number, also called the Employer Identification Number, should be adequately highlighted on the tax document and records the daycare facility provides to the government.

In addition, the IRS dictates that the EIN should be mentioned on the tax documents and official notes if you have any professional alliance with the business, have availed facilities from that business, or provided an additional amount as a charity.

If you own a daycare facility, you must provide the Tax Identification Number to the parents who are availing childcare services and professional facilities from the business. Parents require this number to appeal for childcare expenses through tax returns. There is no requirement of a minimum amount invested by their parents, and as the business owner, you cannot deny providing this information to the parents even if they owe you money.

There are numerous methods to identify the daycare provider’s Tax Identification Number.

- Child care services

First, you can contact the daycare facility directly and request the company’s Tax Identification Number (EIN). The EIN is known to the business employees; however, you may contact the business owner or the proprietor if the employees have no access to this number. If the business is small or acting as an independent entity, you can send them an IRS form W-9 to request the number. The owner is bound to provide this information as well as the official name and address of the small-scale business.

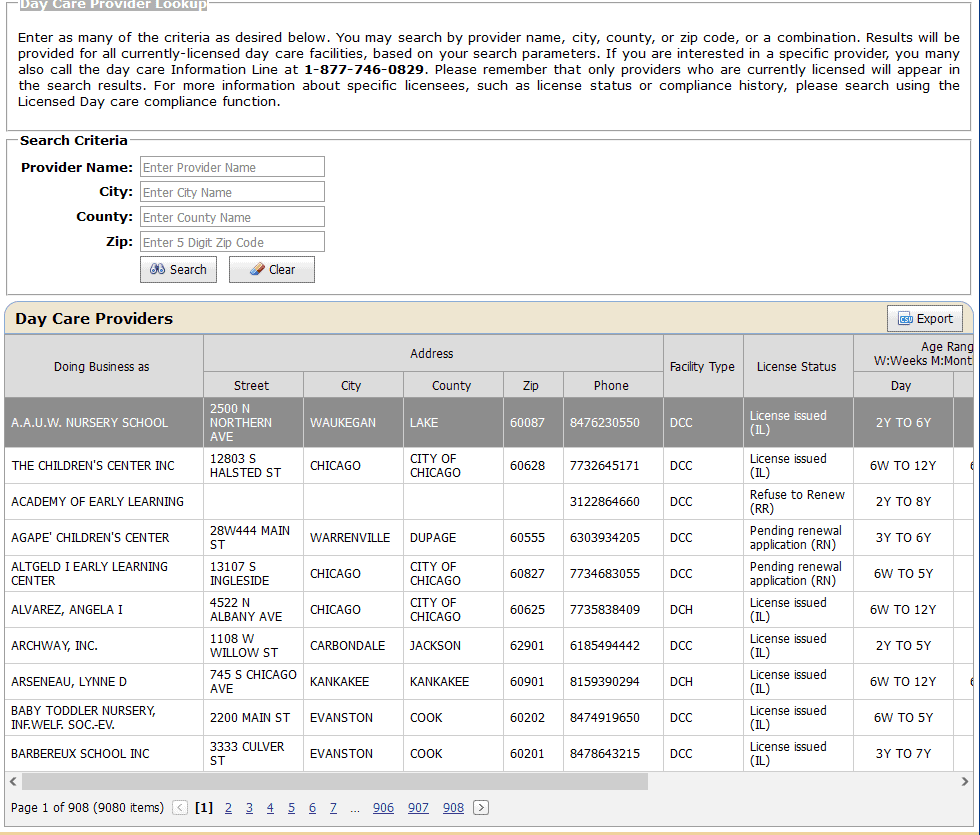

For example, you can visit Illinois’s Illinois’sovider Lookup website.

- Securities Exchange Commission

Public entities habitually provide financial records and official documents to the Securities Exchange Commission to provide information to investors who can analyze investment opportunities. If the childcare program is a part of a public company and operates publicly, the Securities Exchange Commission documents will have the Tax Identification Number. The SEC-related number can be found on the Edgar database by mentioning the name of the daycare business.

- GuideStar nonprofit directory

You can find the EIN through GuideStar.org if the daycare business is a nonprofit. This is a reliable platform for sharing EIN with nonprofit companies and encouraging them to be transparent regarding their business. This platform works on sharing the EIN for better results, consistency, clarity, and credibility maintenance. You can also search for EIN on websites such as MelissaData.com and Research.co.m

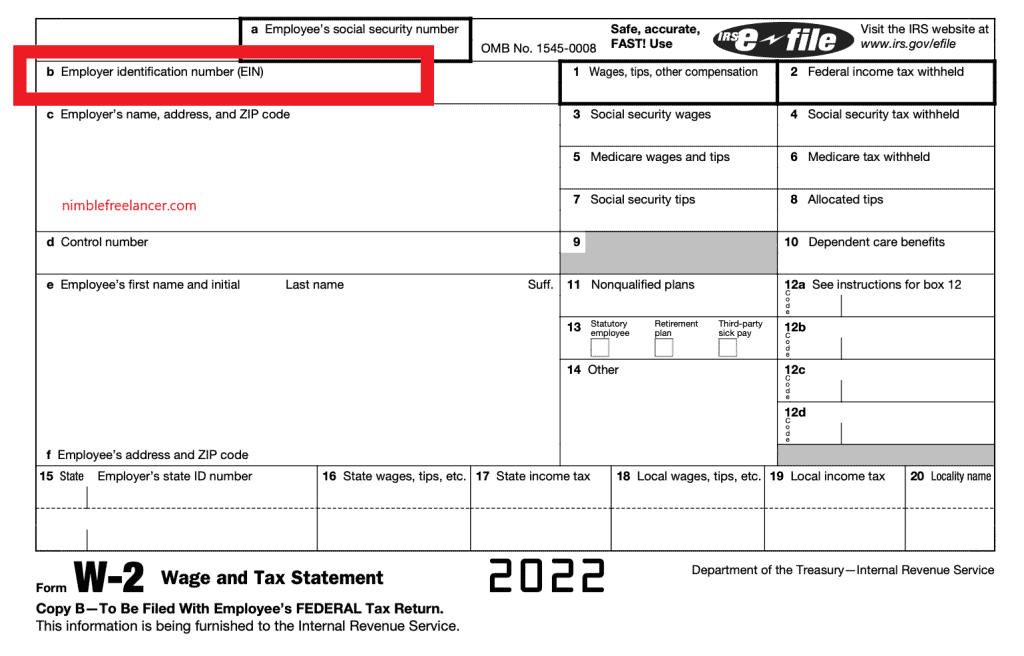

- W-2 form

The EIN is a necessary document for tax-related papers and files. If you are a daycare employer, this number is available on the W-2 form.

A W-2 form is the fastest way to find your daycare EIN. Your EIN can be seen in the upper left corner, just like in the image below:

- Social security number

Social Security numbers can also be used as an alternative to EINs. This option applies if the daycare services operate on a small scale and have no employees. Other conditions should also be met for the social security number. If the business is sole proprietor, the IRS has a different state, such as its limited capacity.

The EIN is also included in the monthly billing record sent to the parents. Certain businesses mention their EIN to save time and avoid complications.

The entire concept of child credit tax involves monetary returns for having more children.

As per the latest trend set by The Economic Growth and Tax Relief Reconciliation Act of 2001, the credit tax has been increased from $500 to $1000. This was recently augmented, and you can claim child credit tax up to $2000 per child in 2021. If you have more than three children, this amount can go up to $6000, and you are eligible to receive $1400 per child. Apart from the age and other legal requirements, there are income limits, too. It would help if you met the income threshold to be eligible to claim the child tax credit. Full-time college students aged 17-18 or 19-24 receive a throwaway monetary compensation of around $500 per child.