Taxpayers paying for daycare out of their pockets are eligible for child-dependent care credit. While working or seeking a job, people and their spouses responsible for paying for the care of a dependent child or disabled spouse can take advantage of this tax credit. A person’s income level determines whether costs are qualified for tax credits. A maximum dollar amount may be claimed. The American Rescue Plan Act made a critical adjustment to this credit, which took effect on March 11, 2021. This act increased the credit’s generosity and made it possibly refundable.

One individual can claim up to $8,000 in costs in 2021; two or more persons can claim $16,000. Depending on your AGI, you may be able to deduct 0% to 50% of your actual costs. If your AGI is less than $125,000, you can claim the maximum proportion of costs (50 percent). When you have an AGI of $75,000 and a cost for one qualified individual of $8,000, the tax credit is worth $4000 (or 50% of $8,000). If your AGI exceeds $125,000, the tax credit decreases until it is eliminated at $438,000 or above.

To find daycare EIN, read our article.

Can I file for daycare without their EIN?

Yes, you can file for daycare without their EIN, but you must provide an SSN. Form 2441 must be completed and submitted with Form 1040.6 to get the credit. A genuine taxpayer identification number (TIN) is necessary for each qualified individual. Typically, this is the person’s Social Security Number. If you have a kid, spouse, or other dependents cared for by someone else, you’ll need to provide their names, contact information, and TINs.

As a final precaution, ensure your documents indicate the severity and duration of your dependent or spouse’s impairment. Record your work-related costs to back up your credit application.

People who are unable to self-care cannot dress, clean, and eat independently or depend on that person’s undivided attention to be safe or keep people safe. In contrast to deductions, tax credits reduce a person’s tax bill in a dollar-for-dollar manner. You must have hired anyone to care for the kid or another qualified individual while you worked to receive the credit. Based on the earned income & adjusted gross income, the proportion varied between 20% – 35% of allowable costs in 2020. (AGI). If your AGI was more than $15,000, the credit was reduced. One qualified person might claim up to $3,000 in paid expenditures, while two or more people could cover up to $6,000 in expenses. A single eligible individual might receive a maximum credit of $1,050 (35% of $3,000) or $2,100 (35% of $6,000) in 2020.

How can I claim childcare credit with no EIN or SSN?

You cannot get child care credit without an EIN or SSN. According to federal law, childcare providers must submit SSNs or EINs to their clients no later than May 31, 2022, for the 2021 tax year. Failure to use them might and most likely will lead to an audit of the service and substantial fines.

The childcare provider has a straightforward option, which I can understand if you don’t want to submit your real SSN. On the internet, they can get an EIN in around 10 minutes. It’s good to tackle this material with a polite, instructive tone.

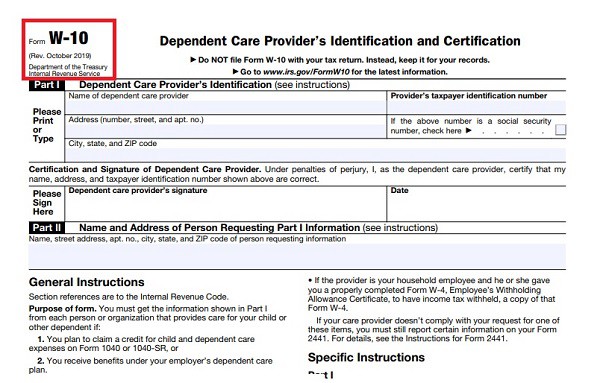

You must send a W-10 to your service provider if they continue to reject. Form FW10 is available online and can be obtained by downloading it, filling out what you can, and mailing it by certified delivery. Taxpayers who haven’t received their refunds in 10 working days can still file their returns. However, e-filing is not an option. There is no option except to send it in. The W-9 you provided to the provider and the documentation you emailed them through certified mail should be included in the mailing. You’ll still be able to deduct the cost and receive your reimbursement. All that may change is the timeframe.

You can claim up to $16,000 in compensated costs if you have more than one person. Taxpayers who make less than $125,000 a year are eligible for a 50% tax credit under the new regulations. The proportion decreases between 50% – 0% as AGI rises. You’ll be eligible for a credit of 25% of your qualifying costs if you have an AGI between $173,000 and $175,000. There is no credit if you have an AGI of $438,000.

Individuals under $125,000 are eligible for a 50% tax credit. For every $2,000 increase in AGI beyond $125,000, the percentage decreases by one point. At $438,000, the percentage phases out. Even if you don’t owe any taxes, you may still be eligible for a refund, so the credit is refundable. The difference between your tax bill ($1,000) and the credit ($2,000) you are entitled to potentially results in a refund ($1,000). If your taxes were reduced to zero due to using the credit, you would not be refundable, or any remaining credit would be lost.

Conclusion

If your business offers a Flexible Spending Account (FSA), you may get a higher tax advantage by using it. Expenses spent using pre-tax monies, including those in a variable spending account, cannot be deducted from your child & dependent care credit (FSA). As a result, people with higher tax rates are more likely to benefit from the opportunity to pay using pre-tax cash.

American Rescue Plan raised the 2021 child care FSA contribution maximum to $10,500 for married couples filing jointly and $5,250 for couples filing separately. As a one-time exception, under the American Rescue Plan, single taxpayers and married couples filing jointly can claim an additional $5,000 in exemptions in 2022. Your pre-tax earnings are deposited into a non-interest-bearing FSA account that you can use to pay for qualified expenses.