Very often, you can hear the “hire purchase” term. This article will help you understand the practical meaning of this term.

What is Hire Purchase in Business Law?

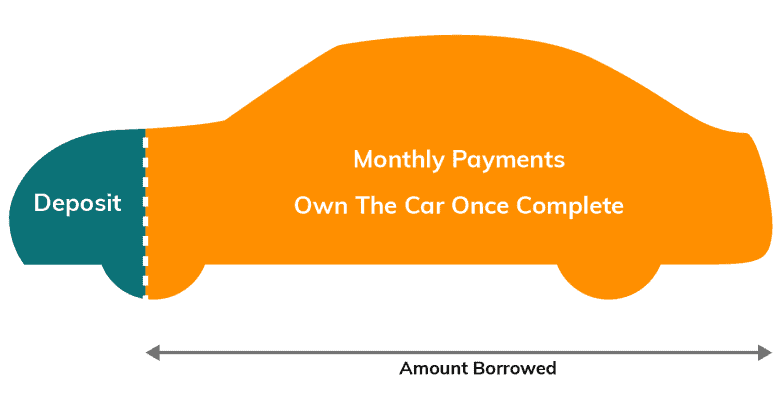

Hire PurchasPurchaseents are a credit agreement in business law where buyers buy costly goods in installments by making a down payment at hire. For example, you hire an item, such as a car, and pay the agreed amount monthly, but you do not own the vehicle until you make the final payment.

In a hire purchase, the buyer or the hirer agrees to pay an interest to the seller for the consumer goods they are purchasing. The buyer usually makes a down payment of the partial value of the good, and the rest is spread across installments.

Hire purchases can be deemed a rent-to-own agreement. Here, the ownership of the good is not entirely given to the buyer until the complete payment is made. The buyer can settle the total amount and get the ownership; until then, the ownership remains with the seller.

Is Hire Purchase Interest Tax Deductible?

Installments paid towards the hire purchase can get partial tax benefits. If the good is purchased for a business purpose, the interest paid is eligible for a tax deduction. If the good is hired for luxury, there is no tax benefit.

For example, a self-employed or a business owner enters a hire purchase contract for a car used for business purposes only. They can get tax benefits on the interest paid on the loan (the remaining payments). On the other hand, if the car is purchased for personal use, it is considered a luxury buy. Therefore, they can avail themselves of themselves of no tax benefits.

One point to note here is that the car’s value (the principal amount) is subject to a tax deduction in neither of the above cases.

What is the Formula for Hire Purchase?

The Hire Purchase amount can be calculated by finding the sum of the buyer’s payment, installments, and interest.

Hire Purchase = D + (P – D)x(1 + RN)

Here, P = Principal Amount

D= Down Payment

R= Rate of Interest

N= No. of years of hire purchase

Let’s use an example to understand this formula. A car with a principal value of $32,000 is bought on hire purchase. The initial deposit made by the buyer is $7,000. The remaining amount is to be paid over five years, with a rate of interest of 6% p.a. Therefore,

Hire Purchase = $7,000 + ($32,000-$7,000)x(1+5×5%)

= $38,250

The buyer would have to pay $38,250 to hire the car.

What are the Types of Hire Purchases?

There are two types or forms of hire purchase. One is where the buyer and the seller enter the hire purchase agreement directly. The other is where the lender, who loans the hire purchase amount to the buyer, is involved in the contract.

In the first form of the hire purchase agreement, the buyer enters the deal directly with the seller of the goods. They pay the installments, along with interest, directly to the seller. The ownership of the good remains with the seller until the last installment is made, after which the buyer wholly owns the good.

In the second form, the buyer uses a bank or financial institution, which buys the goods on behalf of the buyer and makes the total payment to the seller. The ownership is transferred to the lender, and the buyer pays the installments to the lender, along with interest. The lender has the right to confiscate the goods in the event of non-payment. Here, the good’sgood’sship is also transferred after the last installment is paid.

What are the Elements of Hire Purchase?

The primary elements of a Hire Purchase agreement may include an Agreement between a buyer and seller, Transfer of Possession, Deposit or down payment, Interest Rate, Time Period of the Agreement, and Transfer of Ownership at the end of the agreement. All these elements form a Hire Purchase agreement.

Some essential elements together make a hire purchase agreement. There must be an agreement between a buyer and a seller of a good, where the seller must transfer possession of a good when the buyer makes a deposit. There must be a contract where the buyer promises to make the remaining amount in installments for an agreed-upon time. Also, the transfer of ownership must be done after all the installments are paid.

What are the Rules of Hire Purchase?

The following are the standard rules of a hire purchase agreement:

- The hirer cannot exercise their ownership of the good until the full payment is made. Till then, it is only a hired product.

- The hirer has to make the payment as and when agreed upon during the signing of the agreement.

- The seller is the rightful owner of the good till the full payment is made.

Is a Mobile Phone Contract a Hire Purchase Agreement?

Mobile Phones come in every price range, from basic models that are cheaper to the advanced and latest ones that can be expensive. Mobile phones in the higher price range are often purchased on hire by making a small deposit and the rest of the payment in installments.

Newly launched mobile phones may cost someone three months to purchase with the latest technology and advanced features. But that doesn’t stop them from purchasing such high-tech devices, as they can buy them on hire by paying a small fraction of their value as a deposit and the rest in installments. It is implied that they will only get ownership once they have paid all the installments.

Are Hire Purchase Agreements Secured?

If we look at the degree of protection of a hire purchase agreement, it is more inclined towards the seller than the buyer. As the seller owns the good or product in the contract, they have the right to confiscate it in the event of failure to pay by the buyer or hirer. This makes the buyer lose the money which they have already paid.

As the ownership is only transferred after the seller receives the last payment, the good is more like being hired than owned by the buyer. The hirer pays a deposit and installments that include high interest rates and interest rates to get ownership of the good. If, due to unforeseen circumstances, the buyer cannot pay the installments, the seller loses possession of goods, resulting in the loss of the payments that have already been paid.

Is a Hire Purchase Agreement a Contract?

Hire Purchase agreements can be viewed as rent-to-own contracts, where the goods are not transferred; they are more like renting until the final payment is settled between the hirer and seller/owner.

The hire purchase agreement can be interpreted as a contract of bailment, in which the hirer does not legally own the good but has the right to use it at their disposal.

What are the Legal Provisions of the Hire Purchase System?

The Hire Purchase Act of 1972 mentions the hire purchase agreement’s requirements. These provisions are as follows:

- The hirer must transfer possession of goods to the owner, with the agreement to pay periodic payments.

- The ownership of the goods must be transferred when the last payment is received.

- The parties involved in the agreement must sign the contract.

- The hiree or owner has the right to take possession of the goods in the event of non-payment of the agreed installments only after giving prior notice to the hirer or buyer.

- The hirer can terminate the agreement anytime before the end of the contract.

What are the Advantages and Disadvantages of the Hire Purchase System?

A hire purchase agreement has advantages and disadvantages for both the buyer/hirer and the seller/owner. As a benefit of the agreement, the buyer can buy expensive goods they cannot purchase in one go, which may affect their capital. The seller benefits from the increases in sales as more people can now buy their expensive products. A disadvantage of the agreement is that it involves a higher interest rate.

A hire purchase agreement can benefit in certain ways. It helps a company to buy goods, like machinery and other tools for the company. These goods can be expensive, and a business may have to pull out a significant chunk of its working capital or raise debt if they make a full payment at the time of purchasPurchasepurchasPurchasets such implications.

However, hire purchase agreements involve payments that generally include higher interests. The amount paid towards a hire purchase agreement will cost more than a one-time payment. As a result, many buyers buy more than they can afford.