In this article, we will write about money orders and what to do if you find a blank money order.

What is a money order?

A money order is a paper certificate issued by a bank or government that allows the payee to receive cash on demand. It is a safe alternative to personal checks or cash.

The trail of money paper begins with the money and the money order. Upon receipt, the recipient signs the return and inputs the bank number for the deposit. Similarly, the beneficiary might bring it to her bank and cash it on the spot to obtain cash.

You will undoubtedly want that money back if you buy a money order, but you don’t like it now. So, the issuer of the money order, depending on whether you have approved it to the intended payer, is the casting of the money order you did not use.

What does a money order look like?

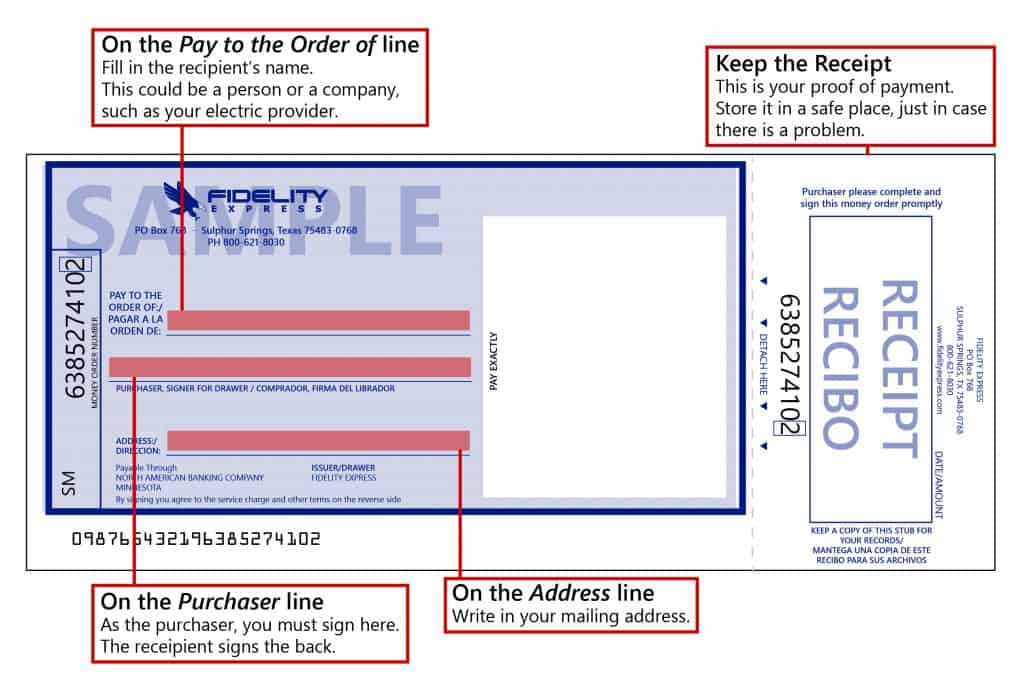

A money order looks like the image below and provides name, address, additional address, and signature information.

Money orders vs. checks

A check is a paper form written off your bank balance, while a money order is a financial document you paid for an early purchase. Both are worth the same as currency. A primary distinction between the two is that you may run the check through the shredder to trash it if you write a check to a beneficiary and then change your mind about completing the transaction. With a money order, it is also not easy to do so.

Not all users can deposit physical or paper checks using the Cash App. You can read more about this topic in our article, where I can load money on my Cash App card.

I Found a Blank Money Order. Can I Cash It?

Yes, theoretically, you can cash the blank money orders. However, if you are not the recipient of the money, do not cash the money order. Theft of lost property, such as a blank money order, is a crime (Penal Code 485), and you can get up to 6 months in jail.

When you find a blank money order, you should do your best to locate the rightful owner. To help you do this, take-down any information on the money order, including the recipient and issuer’s name and any other information provided on the money order itself.

If you cannot locate the rightful owner of the money order, you may attempt to cash it yourself. However, due to the risk of theft or fraud associated with cashing blank money orders, it is best to avoid doing so unless necessary.

If you must cash a blank money order for some reason, take all precautions against identity theft or fraud. This may include verifying any information provided on the money order before cashing it and always protecting your personal information.

In addition, if possible, try to cash a blank money order in person at a bank or currency exchange rather than using an online service or mailing in the money order. This will help protect you from scams and ensure your funds are safely handled and deposited into your account.

Finally, remember that if you are not authorized to cash a blank money order for someone else – whether due to theft or simply because it was not intended for you – it is important not to do so. Not only could this be considered theft of lost property under state law, but it could also open you to further fraud.

“California Penal Code 485 PC prohibits the misappropriation of lost property. In simple terms, this is where you come upon someone else’s lost property, and you keep it, despite there being clues identifying the rightful owner.”

Can you cash a money order written to someone else?

Yes, you can cash a money order written somewhere else. For example, you can cash orders to your friend by signing your name on the back. Then, you can endorse the money order to someone else using your ID.

Where can I change a money order?

You can change a money order at the bank, money order outlet, credit union, post office, grocery, department stores, or check-cashing stores.

- Could you take it to the bank?

You might deposit the money order into your bank account if you do not have one. Please add your name in the receiver box if the money order is blank and endorse the money order back. You can offer it to a teller then, either. Several banks, including Chase, Wells Fargo, and Bank of America, will charge a fee if you don’t have a bank account. Every bank has requirements, so check with the bank to determine precisely what you need to accomplish. Also, each location has cash orders for others, so you must contact the bank and find out exactly what’s happening.

- Head to the Original Location

Return the cashier’s check to its place of buy to try to pay it for itself. Like the US Postal Service, many money order vendors will pay them for cash if they have money on hand, but some merchants may not pay cash. But it can’t hurt to contact the place and inquire. It is also helpful to have both components of the money order with you: the money order and the receipt register.

- Visit Grocery or Department Stores

Your neighborhood food shop might be a cash-order alternative. First, check with the shop to establish the cash order requirement. For instance, a food business can only cash out a money order up to a limit of $500 or can only issue cash orders to that store.

- Use Check Cashing Stores

If you have to check cash shops in your region, there is another way to cash an order. Each check cash outlet, like the banks, establishes its regulations and costs for cash orders. However, be careful; the fee is probably considerably more significant than in a bank if you go the path. For example, Western Union asks buyers to complete a form and pay a $15 reimbursement charge. Western Union likewise takes 30 days to complete this application.

So, to sum up:

Where can I cash a money order?

You can cash a money order in your bank, grocery store, department stores, US postal service, Western Union, MoneyGram, and various money exchange service companies. But, of course, the best place to place a cash order is the post office because you can do that without any fee, for free.

Do money orders expire?

No, money orders do not expire if issued in the US. Domestic money orders do not accrue interest and do not expire. However, a non-refundable service fee will be charged if you do not cash your money order for 1 to 3 years.

Complete your order correctly.

Specific complexes, leasing companies, or real estate organizations need money orders for all payments. It’s a simple process to complete a money order once you learn how to do it correctly.

Where can I get a money order?

To get money orders, you can go to the bank, the US Postal Service, Western Union, MoneyGram, food shops, pharmacies, convenience stores, and major boxing stores. Banks and credit unions sell money orders but charge between 5 and 10 dollars apiece. The US Postal Service sells money orders for around $1.25 apiece.

Can you order money with a gift card?

You can buy a money order with prepaid Visa or Mastercard gift cards at various grocery stores. However, some banks and grocery stores do not allow gift card money order purchasing. Therefore, you need to check if they accept your gift card at the location where you are purchasing money orders.

With either cash or a debit card payment for the money order and its service charge. These guaranteed funds are employed since there is also a guarantee of the money order. Checks can fail, and direct debit operators may request a fee; money is not guaranteed in these circumstances. If you suggest you can pay by credit card, be careful. You can only pay with a credit card in cash on your card, which might bear high costs.

How to cash a money order?

To cash order, do the following steps:

- Go to a location where you can cash orders (e.g., bank, grocery store, retail store, post office).

- Approve your money order

- Verify your identity using a photo ID

- Be prepared to pay the cash-in fee.

- Take your cash.

How to fill out a money order?

To fill out a money order, you need to:

- Then, in the “pay to” field, fill in the name of the money order recipient.

- In the purchase section field, fill in your address

- In the memo field, fill in the account (order) number.

- In the “purchaser’s signature” field, fill in your name.

Let us give one example :

How do you fill out a Fidelity express money order?

To fill out a Fidelity express money order, you need to:

- Then, in the “pay to the order” field, fill in the name of the money order recipient.

- In the “address direction” field, fill in your address

- Fill in your name in the purchaser line (Signer for a drawer).

- Keep the receipt as proof of the payment.

When you purchase the money order, you request the sum stated thereon. It is easy to complete: Use black ink and write great lyrics to avoid changing your information. Then, in the “Pay To Order Of” field at the top, enter the name of the individual or business. Make sure you spell it accurately because you can’t modify it.

The buyer or sender is you. In this field, he might say ‘from,’ ‘buyer,’ or ‘sender.’ Enter your full name, and fill it out if there is an address line. Some merchant accounts contain only one space to name you.

In the lower right area, sign the money order on the front. Don’t enter the money order back; the receiver must sign this field.

Keep your money order detachable receipt once you fill it out and record to whom you sent it. The receipt and the money order for a notice might be additional space. If so, enter the name of your account, “March Rent,” or any phrase so you will know where it was delivered. In addition, the receipt provides tracking information, so you may check if the receiver claims he has received it.

Is a money order like a check? Money order vs. check

- You must pay the total amount in cash to get a money order.

- In money orders, you exchange cash for a piece of paper representing that amount of money, while cash is the opposite direction where you want cash when you give a piece of paper.

- Money orders cost just a few dollars; checks do not.

You may buy money orders in many locations, but the cashier’s check can only be purchased in a financial institution or bank. One can make a cashier’s check for significant payments like down payments on a house, but money orders have a much lesser maximum of around $1,000 apiece. For example, you must acquire three money orders of $1,000 each if you pay $3,000.

Can you return a money order?

Yes, you can return the money order to the location where you purchased it (bank, grocery store, post office, etc.) and explain why you want to return it. In the next step, you will submit a cancelation form and receive two options: to replace the money order or to refund the money (the same amount as the purchase price).

How to correct a mistake on a money order?

To correct mistakes on money orders, you need to ask the cashier to cancel the money order and request a new one. Do not correct your error on the money order; ask for a refund and cancel. If you change your money order yourself, it will make the order ineligible for cashing.

Does CVS do money orders?

Yes, CVS makes money orders at around 10,000 locations. However, remember that the maximum amount per money order at CVS is $500, and the minimum is $1.25.

So let us see if we can get a money order at Walgreens:

Does Walgreens do money orders?

No, Walgreens does not sell money orders to clients. However, instead of money orders, Walgreens provides Western Union transfers. The transaction limits imply that you can receive up to $300 per transaction and send a money transfer of up to $6,000.

Does Walmart do money orders?

Yes, Walmart sells money orders using only the Moneygram service. The money order transfer limit for Walmart is $1,000. In addition, you need to provide a government photo ID and pay a maximum fee of $1. You can buy money orders at Walmart from 7 a.m. to 11 p.m.p.m., and, for some local,tions, 24/7.

Does Circle K do money orders?

Yes, Circle K sells money orders. The service fee ranges from $0.99 to $1.29. The money order limit is $500. However, you can create multiple money orders up to $2999 daily if you need more.

Does HEB do money orders?

Yes, HEB sells money orders, and it uses Western Union for money orders. You can buy money orders at HEB up to $1000. The service fee is $0.69 per money order.

Does Speedway do money orders?

Yes, Speedway sells money orders using only the MoneyGram service. The money order transfer limit for Speedway is $500. In addition, you need to provide a government photo ID and pay $1.59 per money order. However, you can create multiple money orders up to $1900 daily if you need more.

Do Cumberland farms do money orders?

No, Cumberland Farms does not sell money orders. Although they integrated SmartPay in their stores, you can not use SmartPay for money orders.

Does Randalls do money orders?

Yes, Randalls sells money orders via MoneyGram. However, while Randalls (Albertsons) sells money orders in some stores, it does not sell cash orders.