The credit card, essentially created in the 1950s, is currently the simplest way to pay for the goods you purchase. Simply pressing the card on a reader or computer screen is taking the role of swiping it or inserting it into a chip reader, which is advantageous for both customers and merchants. However, making payments easier has also increased the risk of hacking and fraudulent activity. If you use a credit card, the same personal data is used.

What is a Virtual Visa Card?

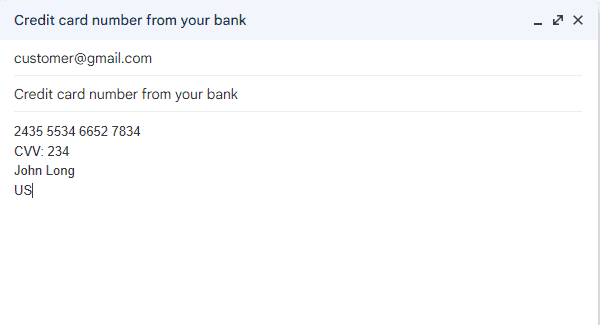

Virtual Visa Cards are generated random numbers with a CVV code provided to the card owner by email or phone. You can use this number for contactless payments in stores by adding it to Apple Pay, Google Pay, or online on websites.

The numbers reflect your bank account or Visa card, but criminals cannot access your information or money using the numbers. Since virtual Visa cards are safer than physical credit and debit cards, many companies now include them in payment procedures.

The Visa card is the most widely used of the four main categories of credit cards. They are popular because Visa cards are globally accepted and may be used at ATMs. As of the first quarter of 2018, there were 342 million Visa cards in the United States and 755 million globally. Virtual cards will eventually be required for all businesses.

Can I use a Virtual Visa Card in a shop?

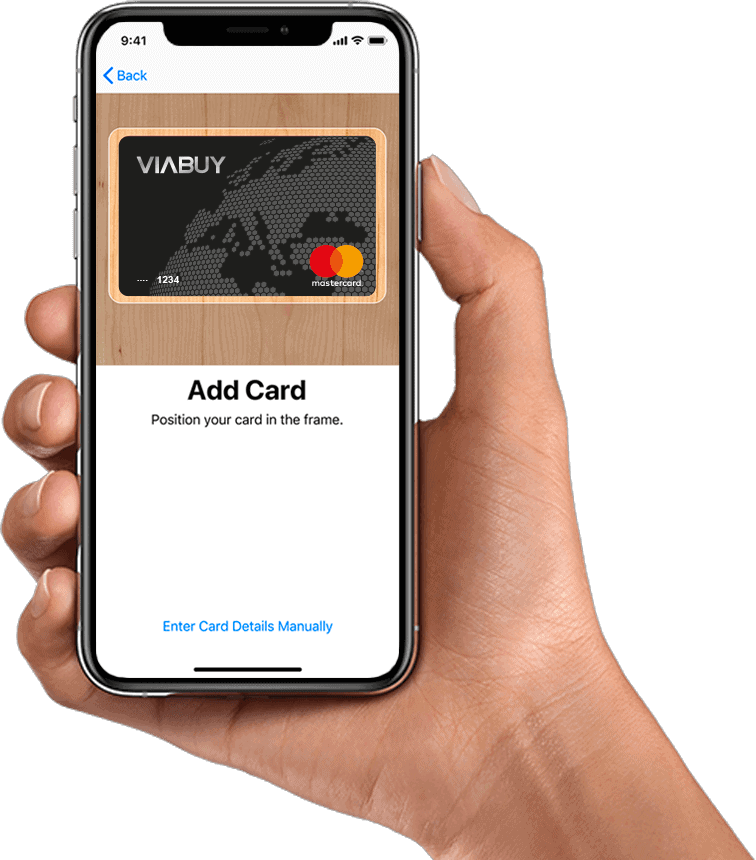

Yes, you can use Virtual Visa cards in the shop if you add the numbers to Apple Pay or Google Pay and use them for mobile contactless payments in stores.

You can easily manually add a Virtual Visa card in Apple Pay:

However, you cannot use virtual credit cards to make cash withdrawals because they are designed for online use only. As a result, using a virtual card to make purchases at shops and shopping malls is impossible without a mobile phone and applications.

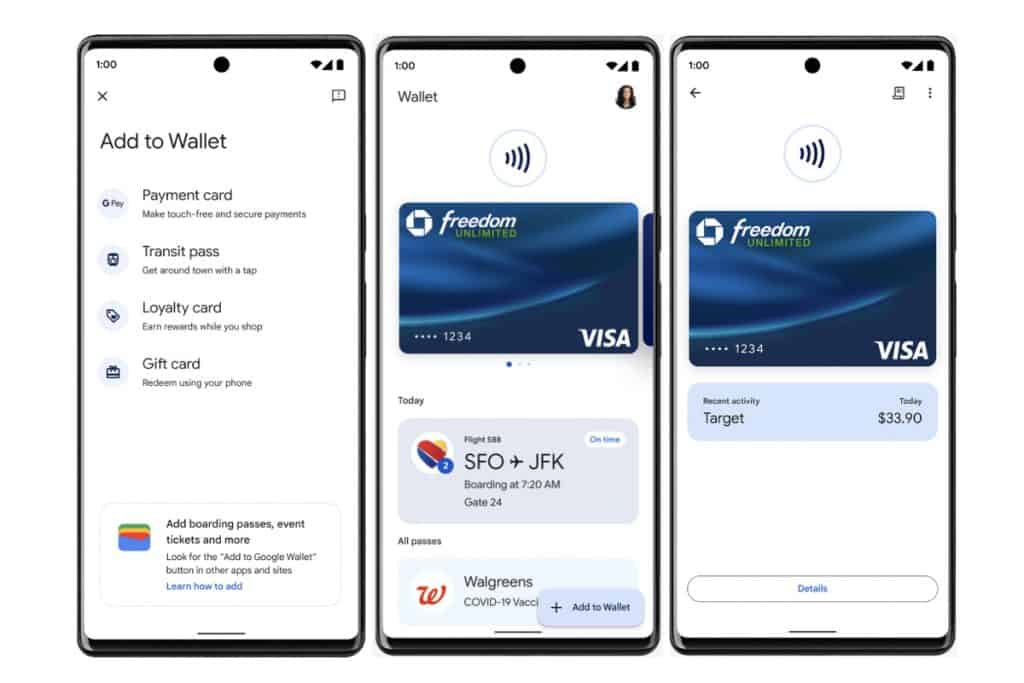

Many more merchants now accept contactless payments than a few years ago. Buses, metros, market booths, bars, restaurants, and other places to eat also accept contactless payments. You may use a virtual card you already have to make contactless purchases by adding it to your digital wallet in Google Pay and Apple Pay.

You can add a Virtual card number to Google Pay:

You should be aware that not every merchant accepts contactless payments and that issues with the technology occasionally cause transactions to fail. This implies that having some cash on hand could be beneficial so you can make your purchase if the payment mechanism isn’t working. Additionally, whether or not a vendor, retailer, or service will accept contactless payments and purchases made using virtual cards is entirely up to them. This implies that you should always research the payment methods for using a virtual card while visiting stores or bars.

What is my mobile wallet?

A mobile wallet is a digital wallet that you can use instead of a physical one to store and use different payment cards, like credit, debit, ID, and gift cards, to make purchases on a mobile smart device.

The phrase “mobile wallet” or “digital wallet” refers to applications that enable you to save card information on your phone and allow wireless payment even when you don’t have a card. Many contemporary cell phones have this option. However, it is frequently only possible on phones with solid security features, such as fingerprint recognition. These features ensure that no one can access your digital wallet if your phone is stolen or lost.

“Mobile wallets” are digital alternatives to traditional wallets that let you pay for things with your phone instead of fumbling with cash or credit cards. You may add various cards to your digital wallet, after which you can decide which card you want to use for payments. You may often add prepaid, digital, and virtual cards to your virtual wallet. Phones were once used to make calls to other individuals. After that, they evolved into tools for email, Internet access, cameras, calendars, and flashlights. They now also function as mobile wallets.

Can a virtual debit card be used at ATMs?

Virtual debit cards cannot be used at ATMs. However, you might be able to use your virtual card numbers to access an ATM using a mobile instead of a card. In this case, if you add Virtual card numbers to your mobile wallet, you can withdraw cash from mobile-friendly ATMs.

Your virtual card may be used online everywhere Visa is accepted and added to Apple Pay, Google Pay, or maybe both. Virtual cards, however, cannot be used to make cash withdrawals from an ATM. Virtual numbers are much safer when making purchases or payments online or with an unidentified merchant or supplier since they cannot be linked to your account or credit card.

When you make purchases, these numbers offer an additional level of security. The organizations you pay won’t be able to overcharge you or use your numbers to make unauthorized purchases on your account. If you don’t use it right away, someone may take a number you produce while using it before it expires.

How do I use a virtual visa card?

If you have a smartphone or similar device that can access your digital wallet while you’re on the go, you may now use it with a contactless payment system. You may include a virtual Visa debit or credit card in your digital wallet. Some retailers might accept a transfer utilizing your virtual card if you have no other options, but you shouldn’t rely on this. If in doubt, always have a backup method of payment available.

Credit card security issues are helped with virtual credit cards. Every time a transaction uses one of these cards, a token is generated and sent between the bank and the merchant to complete the transaction. These can be used over the phone or online. After logging into your account, you can create a one-time token with a unique card number and security code.

Transactions will appear on statements if the virtual card is connected to your credit card. If you already have a credit card from one of the banks that offer this service, you can get a virtual credit card from that bank or link an existing card from another bank to an online service.

Where else can I use a virtual card?

You may use a virtual debit card in the same way that you would a genuine bank card. By adding a virtual card to Apple Pay and Google Pay, you can use them for cashless and online transactions in shops. Some even let you use an ATM to get cash.

Online is where virtual cards are primarily used. Here is where the majority of individuals use virtual cards to pay. It’s fast and easy, and it is the primary cause of the rise in the popularity of virtual cards. Numerous virtual cards, like the card number, feature card information that varies over time. It means that someone could use your credit card if you accidentally use it on a sketchy website or if a website gives out your personal information by accident.

A virtual card could also be usable for mail-order purchases, yet this will depend on whether the telephone merchant accepts this payment method. Because of the time lag between submitting the paper form and the payment passing through, it might be difficult to use this card type while making a mail-order purchase.

Conclusion

Traditional bank account cards, which feature physical cards, have become more of a target for payment fraud because of security hazards. Since you may pre-set whatever spending cap you like at any moment, virtual cards are said to be far more secure and safe than physical cards. In the event of any data leaks that concern you, you can end the account instantly whenever you wish. We hope you have understood everything regarding how to use a virtual Visa card.