We see new versions of credit and debit cards every single day. Sometimes, it is very hard for me to remember everything and which card I can use in which situation.

It’s not undisclosed that the industry for making payments through the internet is flourishing. The rise of online payment methods is visible today, and this style appears to be gaining traction. And there’s a legitimate reason for this to occur. Online payments make it easy for consumers anywhere around the globe to buy things and pay for them without leaving their chairs or phones.

Now, there is a shortcut. You do not need to enter your credit card number, details, or shipping information every time.

What is Visa Checkout?

Visa Checkout represents the Visa digital wallet network, where users can use a single sign-in service to pay for online purchases. You store your Visa debit or credit card information in the Visa Checkout system and then make purchases with a single click.

With Visa Checkout, consumers can pay for their online purchases quickly, effortlessly, and securely from any electronic device, such as a mobile phone, tablet, notebook, or personal computer. When making purchases on the internet or via the phone application of a vocation or provision firm (or after a few sites with a Visa Checkout push button), you must register once to use Visa Checkout.

Any purchases made at participating merchants and service providers (domestically and internationally) may be made with a single click of the Visa Checkout button. Additionally, the payment procedure is substantially simplified to eliminate the need to manually input card data (expiration date and card number).

By streamlining the payment procedure, this service encourages more people all around the globe to shop online and with their mobile devices. Too far, merely 65 percent of all online transactions worldwide have resulted in an “efficacious fee” confirmation.

The numbers are considerably worse for mobile payments, when roughly 35% are processed successfully. While PayPal has a success rate of over 98%, Visa Checkout is 82%—more than 2,200 economic organizations now partner with Visa Checkout.

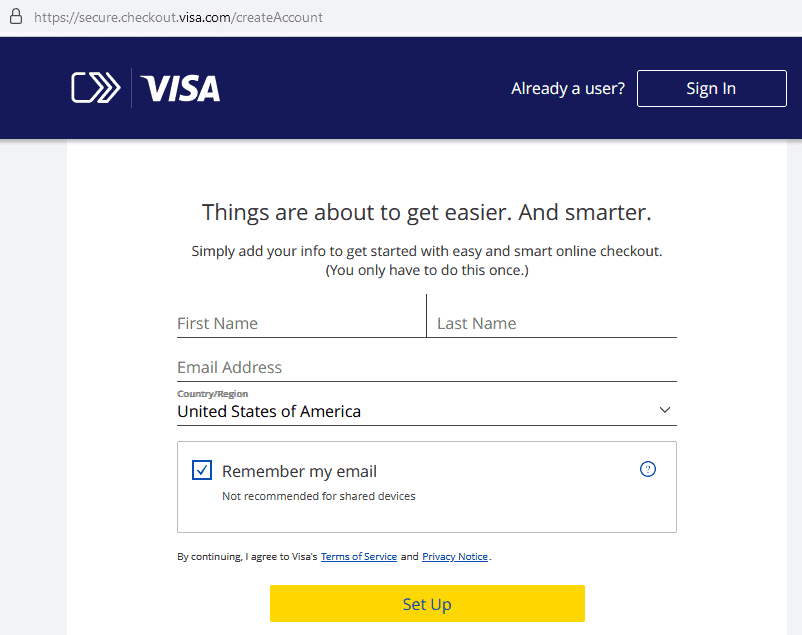

How to use Visa Checkout?

- Go to visacheckout.com and register.

- Add your credit card numbers, personal details, and shipping address information.

- When you purchase using a Visa credit or debit card, you can buy with a single click without adding additional information.

Surprisingly, Visa Checkout is not limited to Visa cards. You may save credit or debit card information from any chief compensation processor. For instance, your system can accept Visa, Mastercard, American Express, and Discover cards. Additionally, Visa Checkout card addiction is not limited to the Visa website. You may pay using Visa Checkout on any site that accepts the payment method. This system is very much like MasterPass.

After submitting your information, you will be given the option to provide authorization to complete the procedure. Your approval to practice Visa Checkout will be complete after the system verifies your identity as the cardholder.

Visa Checkout advantages

- Saving your credit card information means you won’t have to keep entering it;

- One positive aspect of the method is its adaptability. You may also practice MasterCard, Discover, or American Express in addition to Visa;

- To use Visa Checkout, you must first enter your credit card information on one of the participating sites.

- Because Visa has unique advanced compensation safety methods in the world, using the system is risk-free;

- Furthermore, Visa provides access to exclusive offers and merchants, meaning many of Visa’s online and offline retail partners often run promotions and price reductions.

What is Masterpass?

Masterpass represents Mastercard’s digital wallet network, where users can use a single sign-in service to pay for online purchases. Therefore, you store your Mastercard debit or credit card information in the Masterpass system, connect with your bank, and then make purchases with a single click.

MasterPass primarily interacts with issuing banks. This implies that customers may log in using already-established banking credentials. Let’s pretend (because it’s likely accurate) that you do business with a local bank, which we’ll refer to as a regional bank. Using your local bank credentials, you may directly access MasterPass. MasterPass will detect your local bank debit and credit cards and allow you to pick any of them.

Payment wallet is similar to Visa Checkout – see in this video:

We’ve finally arrived at the most exciting and significant part. Now, let’s compare and contrast MasterPass and Visa Checkout to determine which is the superior payment method.

Masterpass vs. Visa Checkout

- Masterpass and Visa Checkout store your credit card details and speed up online payments.

- Both systems store your shipping details.

- Masterpass system cooperates with local banks, while Visa Checkout does not.

- If you have several bank accounts, you need to store them in the Masterpass system separately.

- Mastepass has greater security through several verification methods (SMS, card screenshots, etc.).

Based on research in several studies, Mastepass and Visa Checkout technology have a high level of trust.

The two approaches are pretty equivalent, and each contains aspects that might be seen as strengths and weaknesses. Since both systems seem to operate correctly, the issue of whether one is more compelling is no longer relevant. It would seem that approval by a large number of shops is essential.

By saying this, we are implying that the winning system will receive the most support from the general public.

In my personal opinion, both payment systems are excellent and easy to use. Masterpass and Visa Checkout are simple to use and can save you time by avoiding entering credit card details and shipping addresses every single time.