Checks are a standard instrument for transferring funds in various scenarios: salary payments, refunds, rebates, or settlements. Sometimes, these checks go uncashed for multiple reasons, and over time, they may expire. Generally, checks are considered stale or expired if they aren’t cashed within six months to a year, but the time frame can vary depending on the issuing bank’s policies. When you find yourself with an expired check, getting it reissued is usually straightforward, although it can require patience and diligence. Here’s a step-by-step guide on how to get an expired check reissued. To learn more about Do Unused Checks Expire, read our article.

How to Get an Expired CheckReissuee?

To get an expired check issued, contact the individual or organization that issued the Check, explain the situation, and formally request an issue. Lastly, follow up on your request and promptly deposit the reissued checCheckn receipt to avoid future expiration. For example, expired checks issued by the U.S. Treasury can be reissued by mailing the cheque to the IRS.

Verify the Check’s Status

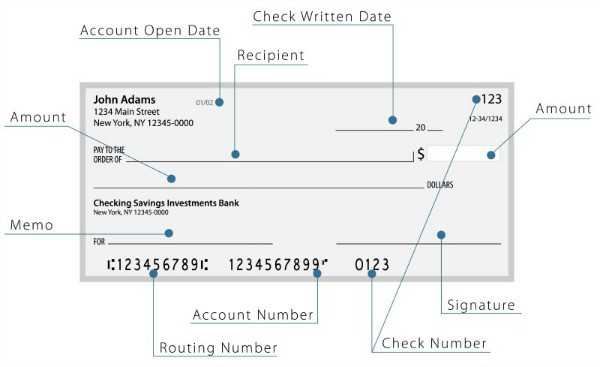

Before initiating the process of having a check reissued, it’s essential to verify that the Check has expired. Check the date on the Check and any fine print on it, and compare that with the typical expiration rules of the bank on which it was drawn. If unsure, a quick call to the bank can clarify the checCheck’stus.

Reach out to the Issuing Entity

Once you’ve confirmed that the checCheckexpired, the next step is to contact the party that issued the checCheck, which might be an individual, a business, or a government entity. Your approach might differ based on the issuing entity, but the key clearly explains the situation and requests that the Check be reissued.

In the case of an individual, you can call or meet them in person, explaining that the Check expired and asking them to reissue it. Remember to return the expired cheque, if possible.

You will likely need to contact businesses or corporations’ accounts payable departments. They may require you to send a written request for a check reissue. In this letter, include pertinent information such as your name, contact information, details of the expired checCheckeck number, date, amount), and a polite request for reissue. If you can, attach a photocopy of the expired Check Checkeep the original for your records.

The process can be more formal and may take longer for government checks. Following their specific procedure, you’ll typically need to contact the appropriate government agency. This often includes filling out Reissueorms and providing a valid reason for not cashing the Check Check once it expires.

Once you’ve sent your reissue request, remember to follow up. If you don’t receive a response within a reasonable timeframe, reach out again. Remembering that this process can take some time, especially with larger organizations or government agencies, is essential.

Receive and Deposit the Reissued Check. The Check has been reissued, and the deposit or cash is made promptly to avoid it becoming stale; it’s always a good practice to monitor your bank account to ensure it has been correctly credited.

Special Considerations

- Stop Payment OreissueAn Issuer sometimes places a stop payment order on the oriReissueeck as part of the reissue process. This security measure prevents the original and the reissued from being cashed. If you later find the original Check and attempt to cash it, a stop payment order could result in it being rejected and cited, and you may incur a returned check fee.

- Fees: Some entities might charge an issue fee, mainly if the check expiry was due to your delay in cashing it. You’ll need to decide whether the check amount warrants the issuance fee.

- Uncashed Check Laws: If you’ve lost a check, never cashed it, and forgot about it, it may eventually be turned over to the state’s unclaimed property division due to “escheat laws.” You can search your name on your state’s unclaimed property website to see if this applies to you. Claiming your money, in this case, might require additional steps, including providing proof of your identity and your right to the funds.

How to Get an Expired U.S. Treasury Check Reissuee?

U.S. Treasury checks are official payments from the federal government, and they can include tax refunds, social security benefits, and other federal payments. These checks generally expire a year after their issuance date. Suppose you have an expired U.S. Treasury check. In that case, it’s important to note that the Internal Revenue Service (IRS), the agency responsible for administering the federal taxation system in the U.S., can reissue it., can reissue it.

Before returning the expired Treasury check to the IRS, ensure you’ve correctly documented its details. Make a photocopy or take a clear photo of both siCheckf the Check for your records. The details you should record include the check number, the amount, and the date of issuance. This information will be crucial for your communication with the IRS and your follow-up on the matter.

Compose a letter to accompany your Check when you return it to the IRS. This letter should clearly state that you are requesting an issue of the Check. Include pertinent details in the letter, such as your full name as it appears on the Check, your current address, and your Social Security Number or Employer Identification Number. Also, add the recorded detail to the Check. For security purposes, avoid including sensitive information on the check copy, such as your total bank account number if it’s there.

After you’ve composed your letter, it’s time to send it back to the IRS along with a checkered Check. You should use a secure mailing method that can be tracked, such as Certified Mail with a Return Receipt Requested from the United States Postal Service. This will give you proof of delivery, which can be valuable for disputes or complications.

Address your envelope to:

Internal Revenue Service 1973 Rulon White Blvd. Ogden, UT 84201

After mailing your request and the checked Check to the IRS, it is essential to monitor the situation closely. If you don’t hear back within a few weeks, you may wish to follow up by calling the IRS at 1-800-829-1954. Be prepared with your recorded check details to help the IRS representative assist you with your request.

Remember, the issue process can take several weeks, so a payment willwill be required. If Your reissued Check arrives, deposit it promptly to avoid having it expire again.

By following this process, you can have your expired U.S. Treasury check successfullyreissuedd and regain access to your rightfully owed funds.

How do you reissue a check to your bank?

To reassure you that a check has expired, you need to ask the bank to reissue a new paper check through the bank’s online bill pay system. You can also visit a local bank branch in your neighborhood and ask for help from a bank teller. Alternatively, you can email the Issuer and ask for a new check.

A check can be replaced if the bank is willing to do so. You can request the bankChecker to return the Check and provide a new one with a new date. This extends the deadline, and you can get the Check within the stipulated time. You can make the request online or visit the bank personally to make a request.

The letter format for Check of the expired Check

If you want to create a Letter RequestingReissuee (Replacement of Expired Cheque), then please download the template in Ms. Word format below:

Letter format for rCheckueof the expired Check

Conclusion

Getting an expired check reissued is straightforward, though it can be a bit time-consuming. The most important thing is to act promptly once you realize a check has expired. Open communication with the issuing entity, patience, and due diligence in following up are essential to successfully reissuing the expired Check.