Many people are concerned about overdraft protection regarding prepaid debit cards. Netspend All Access is an excellent option for those who want to overdraft without facing astronomical fees or unnecessary penalties. So, how much can you overdraft with Netspend All Access?

Prepaid cards are stored-value cards that many people commonly use. Some of these cards can generally be used as any other banking card (Visa or Mastercard) to withdraw cash from ATMs and use it at places where the banking cards are used. These cards require adding value rather than linking it to a financial account.

One such widely used prepaid card is the Netspend card. We discussed this card in our article when we answered where you could cash a government check. This article will focus on using the prepaid card issued by Netspend and the overdraw facility it offers.

Please read our article Does Overdraft Affect Credit Score?

Introduction to Netspend Cards

Netspend was launched in 1999 when prepaid cards were relatively new. It provides prepaid Visa and Mastercard services that can be restored with funds. Since it is not a credit card service that may charge you specific fees or interest to carry out the benefits, Netspend cards are free from extra charges like activation fees. It does not require you to maintain a minimum balance on your card, reload the money, and use it.

Netspend card users have three plans to choose from. PaPay-as-You-Go’sasic plan does not charge its users any monthly subscription fees. However, users have to pay charges for purchases made with the card. Two other programs allow Netspend card users to make charge-free transactions, but these plans charge monthly fees. Suppose you do not wish to pay higher service fees or transaction fees. In that case, you can go for the premier plan, where you have to make minimum deposits monthly, pay minimal monthly payments, and get unlimited cost-free transactions.

To obtain a Netspend card, you do not need to go through a credit check. Just submit proof of identity, which is necessary, and get your card. Netspend cardholders can add or reload funds to their prepaid cards through the bank or direct transfers. They can also use Netspend reload services like network locations set by the company or card account transfer. It also lets you deposit funds through salary checks and income tax refunds.

If we talk about the security of Netspend cards, it protects up to the current limit as it is insured by the FDIC (Federal Deposit Insurance Corporation). It can be used in place of Visa and MasterCard, like ATMs, stores, and malls. But what happens if your car runs out of funds and you cannot find a way to reload the card? Does it allow you to overspend? Continue to know about the overdraw service by Netspend.

Can you overdraft a NetSpend card?

You can overdraft a NetSpend card only if you previously chose the NetSpend Overdraft Protection service. It would help if you accepted the Optional Debit Card Overdraft Service option. If you do not take protection services, Netspend will not allow you to exceed the amount authorized on your NetSpend card.

Does NetSpend have an overdraft?

Yes, NetSpend has an overdraft fee, and you can overdraft a NetSpend card if you are part of the NetSpend Overdraft Protection service. In this case, NetSpend will provide you a 24-hour grace period to avoid an overdraft fee if you bring your account to a positive available balance within 24 hours from the first transaction that created the negative balance.

The good news is that Netspend All Access gives you more flexibility in over-drafting than other prepaid debit cards. To qualify for the overdraft protection, you must enroll and make at least one direct deposit of $200 or more every 30 days. Once registered, your account balance can go as low as -$10.01 before triggering the overdraft protection feature. If your account balance exceeds this amount due to purchase or withdrawal, the service will authorize and cover the transaction.

Netspend charges a fee for each overdraft transaction up to a maximum of three transactions each month; however, these fees are significantly less than what most banks charge. Each fee is only $15 per transaction regardless of the purchase or withdrawal value, so you won’t have to worry about incurring high costs just because you need extra funds.

It is important to note that your access to this service will be canceled if your account has a negative balance for more than 30 days three times or stays negative for more than 60 days at once. If you consistently need extra funds, this may not be the best option unless you can work on budgeting and building an emergency fund so that unexpected costs don’t put you into debt.

However, if you do not accept the Overdraft protection service, Netspend will not allow you to exceed the amount authorized on your NetSpend card.

Overdraw facilities are available on Netspend cards but not for every cardholder. Users must subscribe to an additional overdraft protection service to avail of this facility, and those who do not enroll in this service cannot overdraw their Netspend cards.

But how much can you overdraft Netspend all access:

What is the Netspend overdraft limit?

The Netspend Overdraft limit is $10 because approved purchase transactions may create up to a $10.00 negative balance on your account. You are responsible for repaying any negative balance. NetSpend can allow you three monthly overdrafts, and you will be charged a $15 fee for each overdraft.

Loans or payday advance loans are not available from NetSpend.

Remember that NetSpend will provide a 24-hour grace period to return the money when you can avoid an overdraft fee. So, if you are in less than 24 hours, you will not pay an overdraft fee as a NetSpend Overdraft Protection service member.

Can you overdraft NetSpend at the ATM?

You can use overdraft NetSpend at an ATM, but only if you previously activated the OverDraft Netspend Protection service. Netspend will charge you $15 per overdraft transaction for up to three monthly transactions. But, if you pay within 24 hours and maintain a positive balance on your account, there will be no overdraft fee.

How Does NetSpend Overdraft Protection Service Work?

Those who avail of the overdraft protection service receive an accessible overdraft facility of up to $10. If the cardholder goes below this buffer, they will have to pay overdraft fees of $20 per negative balance recurrence, a maximum of up to 5 times a month. The costs are only charged if the cardholder fails to reload the balance within 24 hours.

However, the company has complete discretion regarding the overdraft facility. It can deny your overdraft transaction at any time. Your marketing can decline after registering for the facility and agreeing to pay overdraft charges.

How To Activate Overdraft Protection Service?

The essential criteria to avail of the overdraft protection service are submitting your email address and agreeing to the overdraft contract terms and conditions sent electronically. This facility cannot be satisfied by simply signing up. Cardholders have to make sure that their deposit history is good. They must deposit an amount equal to or above $200 every month. Regular deposits will make you eligible to avail of overdraft protection services.

If their account balance goes below $10, users will receive a notification of overdraft. After receiving the information, users must reload their account balance above $10 within 24 hours. Otherwise, if they fail to reload the account in time, users will be charged a fee of $20 for the overdraft protection service.

How To Deactivate Overdraft Protection Service?

Netspend overdraft service automatically gets deactivated if a user cannot maintain regular monthly deposits of $200 or more. If users want to restart the service, they cannot renew the old plan but have to reapply for the service. However, users can permanently get banned from the service if they have a negative balance for a continuous period of 60 days or three times for 30 days each.

If the overdraft protection is deactivated for the above or other reasons, cardholders should not revoke the electronic disclosure consent or withdraw their email addresses. Deleting the email address may prevent users from accessing their accounts. Remember that only the overdraft service has been deactivated, not your Netspend card.

How do you see pending deposits on NetSpend?

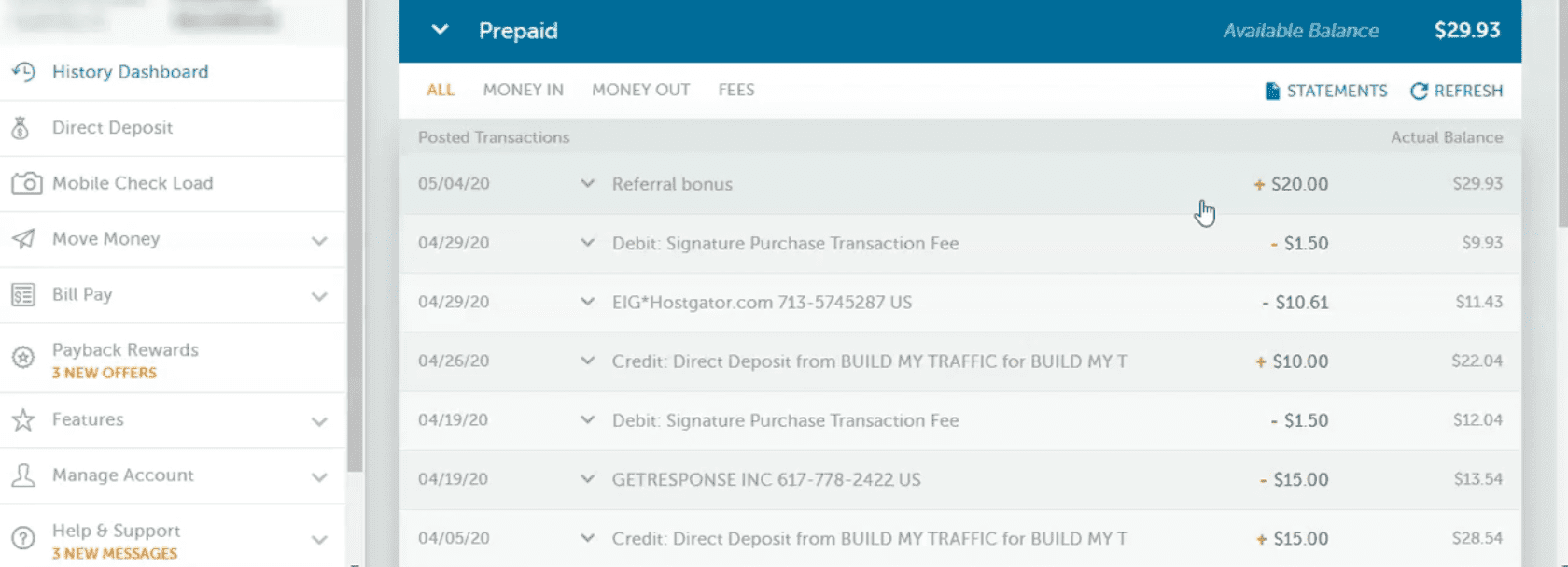

To see pending deposits on NetSpend, you need to log into an online NetSpend account, and in Dashboard, you need to list all your Transactions from the main page. Your deposit is marked as “C” edit,” “You will get details about the pending guarantee if you click it. See the image below:

Overall, Netspend All Access offers competitive rates for those who want to overdraw their accounts without facing massive fees or consequences from their bank. With its low costs and a generous allowance for low balances, it is so wonderful to wonder why many choose Netspend All Access when looking for an affordable and reliable prepaid debit card option with added features such as overdraft protection.