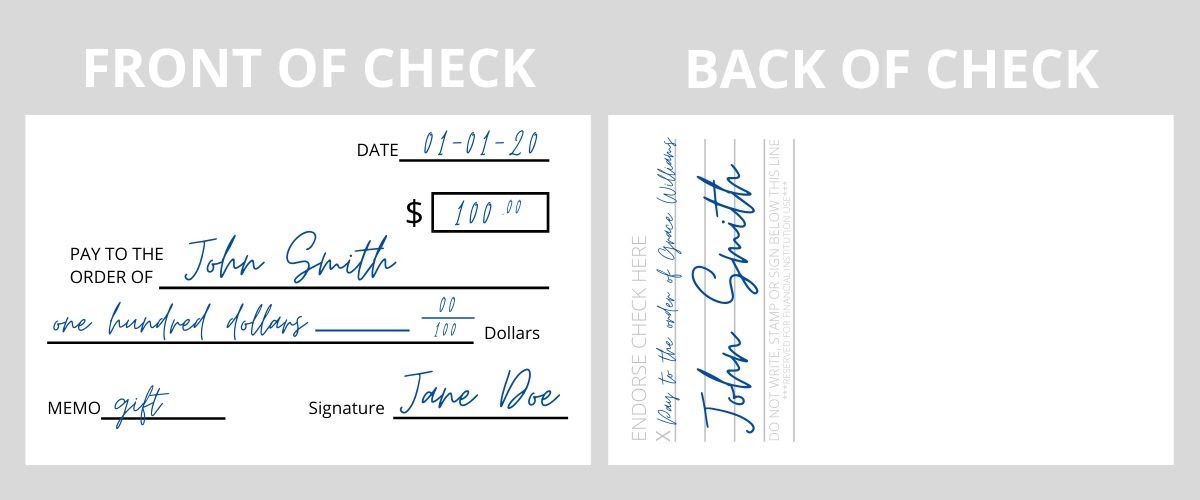

A third-party check is the original payee signs over to a third party, who then endorses it and deposits or cashes it. In other words, it’s a check not made to the person trying to cash or deposit it.

For example, if John writes a check to Jane, but Jane wants to give the money to Susan, Jane can sign the back of the check and write “Pay to the order of Susan” above her signature. Once Susan endorses the check, she can deposit or cash it. However, third-party reviews can be risky for banks or other financial institutions, as there is a higher potential for fraud or disputes over ownership of the funds. As a result, some banks and other financial institutions may have policies or restrictions around accepting third-party checks.

Please read our article to learn Where you can cash a third-party check.

Walmart is one of the largest retail stores in the U.S., known for its wide selection of products, low prices, and convenience. However, one thing Walmart does not allow is third-party check cashing. This policy has been in place for a while, leaving many wondering why. This article will discuss why Walmart doesn’t allow check cashing with third-party providers.

Does Walmart Cash Third-Party Checks?

No, Walmart does not cash third-party checks. Safety concerns are one of the main reasons Walmart doesn’t accept checks from third parties. Walmart wants to ensure that its customers are protected from any fraudulent activity that could occur when using a third-party service.

When processing a check with a third-party provider, there is no guarantee that the recipient is legitimate or that the funds are sufficient to cover the amount being issued. With its internal check-cashing system, Walmart can ensure that all transactions are safe and secure for its customers.

Another reason Walmart does not accept checks from third parties is that it wants to maintain complete control over issuing checks to its customers. By handling the check-cashing process, Walmart can ensure that all policies and procedures are followed correctly and efficiently while reducing costs associated with outside services. Additionally, checking customer I.D.s during the cashing process helps deter fraud and protects customers’ and Walmart’s interests.

Finally, having an internal system allows Walmart to collect invaluable data about who is cashing checks at their locations and how often they cash them. This data helps them better understand customer shopping habits and behaviors, which can be used to improve store layout and product placement within stores and maximize profits by targeting more profitable products towards particular demographics or locations where those items are more likely to sell quickly.

As you can see, Walmart does not allow check cashing from third parties at its locations for several reasons, including safety concerns, control over processes, cost savings, fraud prevention efforts, and data collection opportunities. These factors have made it easy for Walmart to maintain this policy despite some customer complaints about it being inconvenient or restrictive in some cases.

Walmart does allow customers to cash certain types of checks, including payroll and government checks, but its policy on cashing third-party checks can vary by location and may not be allowed at all stores. In addition, Walmart’s policy on third-party checks is generally more restrictive than that on other types of checks, as it requires additional verification and documentation to ensure the check’s legitimacy and protect against fraud.

Additionally, Walmart may charge higher fees for cashing third-party checks than other checks. Therefore, it’s always a good idea to check with the specific Walmart location before attempting to cash a third-party check to ensure that it is allowed and to understand the fees and requirements associated with the transaction.

Does Walmart cash third-party payroll checks?

Walmart does not cash third-party checks because it only cashes two-party checks: government, payroll, tax, pre-printed, cashiers, 401k disbursement, and insurance settlement checks.

However, there are streamlined, reliable alternatives for traditional banking accounts, such as mobile or prepaid accounts. For a small fee, you can quickly deposit money and perform money transactions without a valid bank account. For example, according to U.S. News and World Report, Chase offers customers a prepaid card that provides facilities for money deposit if you deposit a check into the Chase ATM. You can also cash a traveler’s check at any currency exchange place. However, they will not cash personal, business, or government-issued checks.